The benchmark Stoxx Europe 600 gauge dropped for a third week, with food and beverage companies among the biggest losers after Stifel Financial Corp. downgraded brewer Heineken NV’s stock. Shares in the U.K. were were set for a fourth day of losses even as the pound pared its weekly decline with Brexit negotiations under way. The dollar headed for its first weekly gain since May after Federal Reserve speakers did little to alter projections for the path of interest rates, Bloomberg reported.

Weakness in energy prices were the theme of the week, with oil in New York and London dropping into a bear market on concerns that expanding supply in the U.S. and Libya will counter output cuts from the Organization of Petroleum Exporting Countries. In Europe, the battle lines over negotiations to untangle Britain from the union have been drawn, with residency rights and clearing of euro-denominated financial instruments among the first issues making headlines.

“As a heatwave engulfs Europe, equities may suffer from sticky conditions near-term,” Bank of America Merrill Lynch strategists including Ronan Carr said in a client note Friday. “Slowing cyclical momentum, weak oil and policy uncertainty could cause a wobble.”

Here are some upcoming events investors are watching:

- James Bullard, Loretta Mester and Jerome Powell cap a busy week for speeches from Fed policy makers. Bullard told the Wall Street Journal the rate trajectory the FOMC has laid out seems “unnecessarily aggressive” and the balance-sheet unwind should start sooner rather than later.

- Friday’s session in the U.S. will probably be one of the busiest of the year for equity traders as the annual Russell reshuffle is set to take effect. The FTSE Russell’s rebalancing of stock indexes reliably boosts trading, though it rarely triggers big price swings in the market.

- U.K. Prime Minister Theresa May will make a statement to the British parliament on Monday when details of her proposal to safeguard the residency rights of European citizen who currently live in the U.K. will be published by the government.

Here are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index slipped 0.4 percent as of 8:34 a.m. in New York. The gauge is down by the same amount this week.

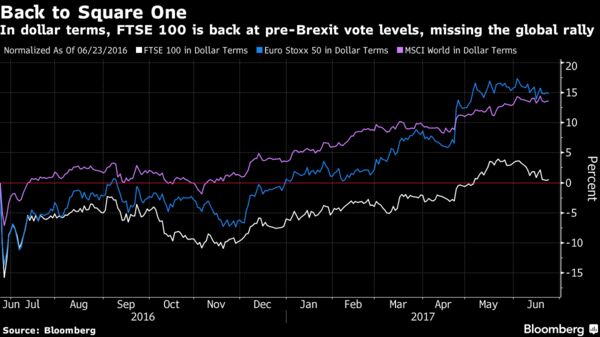

- The FTSE 100 Index was down 0.2 percent, heading for a 0.5 percent weekly decline, its third straight five-day drop.

- The MSCI Emerging Markets Index rose 0.3 percent.

- Futures on the S&P 500 Index were little changed after the underlying gauge fell less than 0.1 percent on Thursday.

Commodities

- West Texas Intermediate crude added 0.3 percent to $42.85 a barrel, cutting its loss this week to 4.7 percent as it fell into a bear market.

- Gold rose 0.6 percent to $1,258.39 an ounce, for a third day of gains.

Currencies

- The Bloomberg Dollar Spot Index fell 0.1 percent. It’s still up 0.4 percent for the week, after rallying Monday and Tuesday on Fed rate-hike expectations.

- The pound strengthened 0.4 percent to $1.2727, paring its drop this week to 0.4 percent. The euro climbed 0.2 percent to $1.1178.

- The yen rose 0.1 percent to 111.21 per dollar.

Bonds

- The yield on 10-year Treasuries was little changed at 2.15 percent.

- U.K. 10-year gilt yields rose one basis point to 1.02 percent, led by losses in shorter-dated securities as U.K. money markets push odds of a rate hike by the end of 2017 over sixty percent.