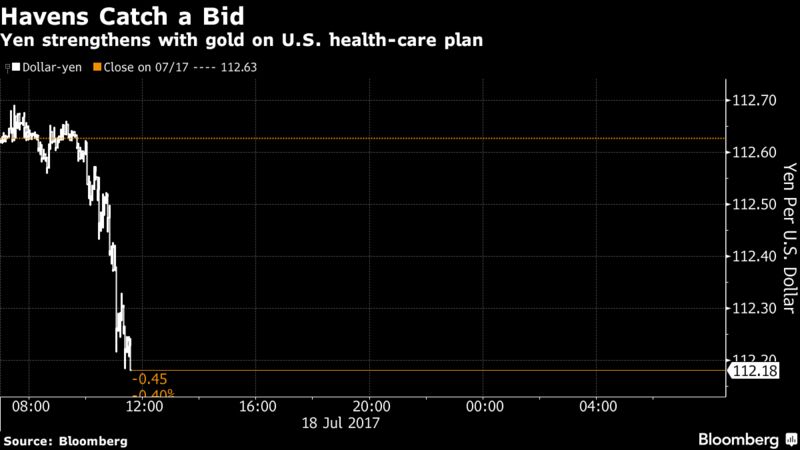

Asian stocks also declined, halting a six-day surge that pushed the region’s shares to the highest since 2008, while Treasury yields dropped. The moves came after two Republican senators said Monday night they oppose Majority Leader Mitch McConnell’s health-care plan. Chinese small-cap equities halted a slide.

According to Bloomberg, Australia’s dollar climbed as its central bank said strength in the jobs market removed some downside risks in wage forecasts, while signaling it isn’t ready to join global counterparts in unwinding policy stimulus. The New Zealand dollar bounced back after slumping as inflation slowed more than forecast in the second quarter, adding to signs that interest rates won’t be increased anytime soon.

The data followed a swathe of recent hawkish commentary from developed-world central bankers that ignited expectations for higher borrowing costs, something that now looks less likely anytime soon, at least in New Zealand. Soft U.S. inflation figures on Friday had contributed to a drop in bond yields. Next up is a read on U.K. inflation.

Some notable investors have become less sanguine about the market as global equities continue to trade near record highs. Laurence D. Fink, chief executive officer of BlackRock Inc., said the U.S. economy is growing more slowly than expected and will expand modestly at 2.4 percent in the second quarter.

Here are some key upcoming events:

- All eyes will be on the U.K. Tuesday when the government releases its inflation data for June. The readings will get extra attention following some recent flip-flopping by Bank of England Governor Mark Carney on the need to raise interest rates. Within a span of about a week late last month, he went from saying this is not the time to lift rates to saying policy makers may need to begin raising them.

- The European Central Bank meets Thursday. Bloomberg Intelligence expects no change then, and no rate hike before 2019. Reuters cited unidentified officials as saying the bank is keen to keep asset purchases open-ended.

- The Bank of Japan is forecast to stand pat at its meeting Thursday.

- Round two of Brexit talks gets underway in Brussels.

Here are the main moves in markets:

Currencies and bonds

- The Bloomberg Dollar Spot Index sank 0.4 percent as of 12:27 p.m. in Hong Kong.

- The kiwi rose 0.2 percent to 73.33 U.S. cents after dropping as much as 0.7%.

- The Aussie rose 1.1 percent to 78.85 U.S. cents.

- Ten-year U.S. Treasury yields slid one basis point to 2.30 percent after dropping five basis points last week.

Stocks

- The Topix index dropped 0.3 percent. It fell as much as 0.9 percent earlier after some officials at the Bank of Japan were reported to be increasingly concerned about the sustainability of its purchases of exchange-traded funds. More on that story here.

- Hong Kong’s Hang Seng Index slid 0.2 percent, while Australia’s S&P/ASX 200 Index was down 1.2 percent in Sydney. South Korea’s Kospi index lost less than 0.1 percent.

- The Shanghai Composite Index retreated 0.6 percent.

- Futures on the S&P 500 Index lost 0.1 percent.

Commodities

- Gold climbed 0.3 percent to $1,237.52 an ounce.

- WTO crude rose 0.2 percent to $46.09 a barrel, recouping some of Monday’s 1.1 percent slide.