The MSCI Asia Pacific Energy Index jumped 1.1 percent, the biggest gain on the Asian benchmark. Equity markets in Japan and Australia followed the advance in U.S. and European stocks after earnings from Caterpillar Inc. and McDonald’s Corp. led to outsize gains in the Dow Jones Industrial Average. Oil rose above $48 a barrel for the first time since early June, while copper extended gains. The Australian dollar declined after inflation data missed estimates, according to Bloomberg.

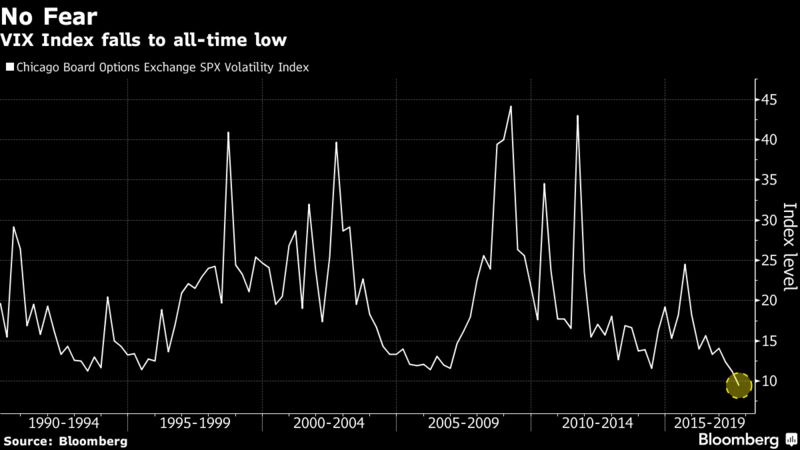

More than 80 percent of S&P 500 companies have delivered earnings that have beaten forecasts so far this reporting period, helping to support optimism in the global economy and bringing down volatility levels to fresh record lows. Investors are looking for clues from the Fed on how it plans to reduce the balance sheet, with policy makers seen keeping interest rates on hold as the U.S. central bank meeting concludes on Wednesday.

Here are some key events coming up:

- Fed policy makers will deliver their rate decision on Wednesday. The central bank will unveil the timing of its balance sheet unwind in September and wait until December to raise interest rates again, according to a Bloomberg survey of 41 economists. More on that here.

- Donald Trump’s son and former Trump campaign Chairman Paul Manafort will go before Senate committees on Wednesday.

- The U.S. economy probably gained traction in the second quarter as spending by American consumers picked up after a lull early this year.

- Results from Facebook Inc., Deutsche Bank AG, Nomura Holdings Inc., BNP Paribas SA and UBS Group AG are among those expected this week.

Here are the main moves in markets:

Stocks

- Japan’s Topix index rose 0.3 percent and Australia’s S&P/ASX 200 Index added 1 percent. South Korea’s Kospi index swung between gains and losses and in Hong Kong, the Hang Seng Index was little changed. The Shanghai Composite Index fell 0.4 percent.

- Futures on the S&P 500 Index were little changed as of 12:37 p.m. in Tokyo. The underlying gauge added 0.3 percent to close at a record 2,477.13 on Tuesday. The Dow Jones Industrial Average rose 100.26 points to finish just shy of its record from July 19. McDonald’s and Caterpillar added at least 4 percent to pace gains.

- The Stoxx Europe 600 Index rose 0.4 percent Tuesday.

Currencies

- The Aussie fell as low as 78.93 U.S. cents after the inflation figures and maintained losses to trade at 79, down 0.5 percent following a speech by the country’s central bank governor. Australia’s second-quarter headline inflation rose less than expected from a year earlier. Reserve Bank of Australia Governor Philip Lowe said his global counterparts’ moves to withdraw stimulus from their economies “has no automatic implications” for policy Down Under.

- The euro traded at $1.1644. It held near the highest in almost two years after German business confidence data beat expectations.

- The Bloomberg Dollar Spot Index was little changed.

- The yen was down 0.1 percent at 111.97 per dollar after declining 0.7 percent on Tuesday in its first retreat in more than a week.

Commodities

- West Texas Intermediate crude rose 1 percent in early trading, extending a 3.3 percent surge, its largest jump since November. Crude inventories declined by 10.2 million barrels last week in an American Petroleum Institute report released Tuesday, people familiar with the data said.

- Copper rose 2 percent, extending a rally on Tuesday that lifted it to its highest close in more than two years. The metal for three-month delivery in London is on course for its biggest two-day gain since November.

Bonds

- The yield on 10-year Treasuries was at 2.32 percent after surging eight basis points. Germany’s 10-year bund yield rose six basis points to 0.566 percent on Tuesday.

- 10-year Australian government notes saw yields climb five basis points to 2.74 percent.