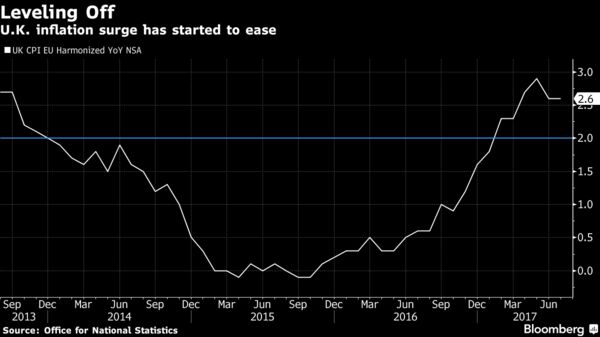

Consumer prices increased 2.6 percent from a year earlier, the Office for National Statistics said on Tuesday. Economists forecast a 2.7 percent rate. The pace of factory input-price gains fell the most since 2012.

According to Bloomberg, economists this month lowered their estimate for how much inflation will accelerate this year because of sterling’s 13 percent decline since the U.K. voted to leave the European Union. With oil prices also down this year, that means price growth may no longer hit 3 percent, as previously forecast.

The pound fell after the data were published and was trading down 0.4 percent at $1.2907 as of 10:42 a.m. in London.

The report supports Bank of England Governor Mark Carney’s case for waiting to raise interest rates from a record-low 0.25 percent even as inflation breaches the 2 percent target. Just two of the BOE’s policy makers voted to increase the key rate this month.

BOE Hawks

“While today’s data will continue to test the patience of some BOE hawks, we expect the committee as a whole to continue looking through inflation spikes in favor of slower growth,” said James Smith, an economist at ING in London. “We don’t expect a rate hike this year.”

The cost of motor fuel kept a lid on consumer prices last month, according to the ONS. Prices for clothing, household goods and food propped up the inflation rate. Core inflation -- which excludes volatile food and energy prices -- was unchanged from 2.4 percent. Input prices for factories increased 6.5 percent on the year, compared with a 10 percent rate in June.

At Bloomberg Intelligence, economists including Dan Hanson said inflation may not yet have peaked, though the overshoot of the BOE’s target remains a temporary currency effect. “It will take evidence of a pickup in domestically generated inflation to alter the Monetary Policy Committee’s thinking -- that looks unlikely in the near term,” they said.

The retail prices index, used by rail carriers to set fares this month, rose 3.6 percent on the year, up from 3.5 percent in June.

Separately, economists in Bloomberg’s monthly survey cut their forecasts for 2017 and 2018 economic growth to 1.5 percent and 1.2 percent. The 2018 pace would be the least since 2009, when output was shrinking. While full-year inflation projections were unchanged, the rate will peak at 2.9 percent at the end of this year, lower than previously anticipated.