Strategists have boosted their year-end forecasts for European gauges in August, predicting an upside of 5.8 percent for the Euro Stoxx 50 Index from Monday’s close. Notwithstanding recent stock declines, money managers have piled into the region’s equity funds for 20 of the past 21 weeks, according to Bank of America Merrill Lynch citing EPFR Global data.

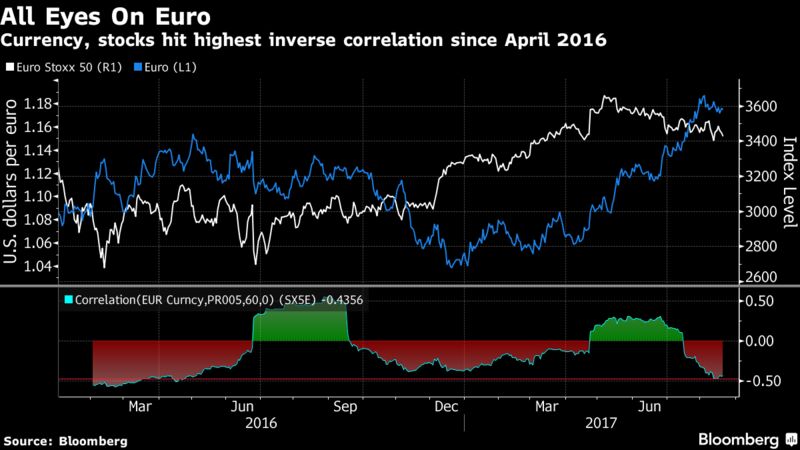

A loss of momentum in the euro’s rally against the dollar, coupled with earnings growth and an improving economy, will boost equities through the rest of the year, investors say. Minutes last week from the European Central Bank’s latest meeting showed officials worried that the single currency may strengthen more than justified, dragging the euro lower and sparking speculation of slower stimulus tapering, Bloomberg reported.

“The best is yet to come for European equities,” Vincent Juvyns, a Brussels-based global market strategist at JPMorgan Asset Management, said by phone. “There is potential for the market to move a few percentage points higher this year, and next year as well.”

Juvyns says he doesn’t expect any sweeping announcements from ECB President Mario Draghi about the institution’s tapering plans this month or the next, and that his optimism is based on factors including government reforms and a stronger economy. Still, traders will watch for clues on monetary policy when Draghi speaks at Jackson Hole, Wyoming, on Friday.

The euro is set to halt monthly gains for the first time since February, taking some pressure off of earnings at Europe’s exporters. Reyl & Cie’s Marco Bonaviri, who expects the equity rally to resume as soon as this quarter, sees a drop in the common currency versus the dollar as the main catalyst for further gains. His firm expects the pair to end the year at $1.15.

“Everything comes down to what will happen to the currencies until the end of this year,” Bonaviri, a senior portfolio manager at the Swiss investment firm that manages the equivalent of $14 billion, said by phone. “A lot of news is already in the price.”

Euro-area equities have fallen 6.4 percent since a May peak as the currency gathered strength. More recent declines have come amid turmoil in the U.S. administration, mirroring global losses. The Euro Stoxx 50 has outperformed the MSCI All-Country World Index so far in August.

Profit expectations and economic indicators also bolster the case for a rebound. According to Morgan Stanley, earnings revisions for the region have moved back into positive territory in the last two weeks, after a sharp drop earlier in the summer. Analysts expect members of the Stoxx Europe 600 Index to increase profits by roughly 13 percent this year, compared with 11 percent for the S&P 500 Index.

The euro-area economy gathered pace in the second quarter as more nations joined the recovery, data showed last week. The expansion was supported by continued growth in Germany and the strongest Spanish performance in almost two years.

“The fact we’ve seen investor sentiment turn a bit means there is room for the rally to do well from here,” Ritu Vohora, an equities investment director at M&G Investments, said in an interview in London. Her firm manages 281 billion pounds ($362 billion). “Even though they’ve moved up this year, equities still don’t fully reflect the improving economic reality in Europe. The fundamentals are supportive. The overall profit momentum is still there.”