Smaller rust-belt banks like Bank of Tangshan Co. and Baoshang Bank have been using products such as trust beneficiary rights and directional asset-management plans to hide the true state of their bad loans and circumvent lending restrictions, the study by analyst Jason Bedford said. Others have been using the shadow loan instruments to diversify away from lending in their struggling home provinces, exposing themselves to a much wider spectrum of Chinese corporate risk in the event of a default, according to the report.

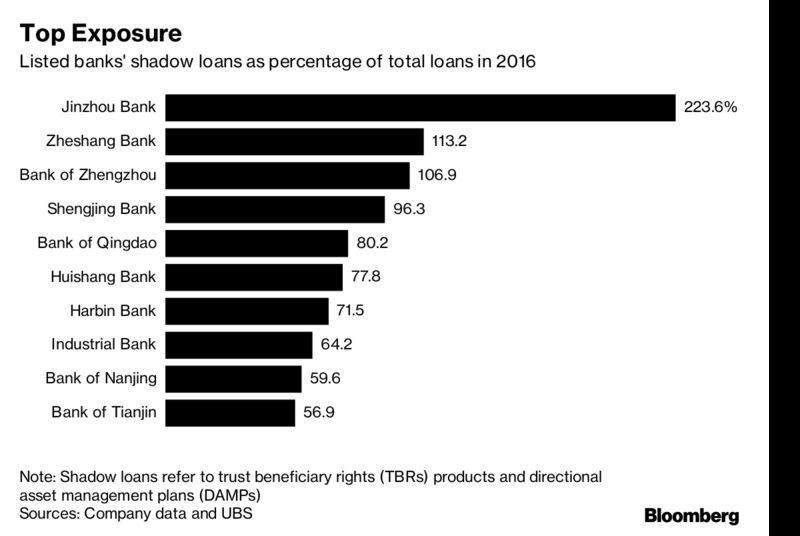

By analyzing 237 Chinese banks, many of them small and unlisted regional lenders, Bedford casts a new spotlight on underground financing and the risks it poses to the nation’s $35 trillion banking industry. Shadow loans grew almost 15 percent to 14.1 trillion yuan ($2.3 trillion) by December from a year earlier, equal to about 19 percent of economic output, he estimates.

“This is a sleeper issue,” Bedford wrote. “The remarkable level of concentration in regional banks in rust-belt region banks, combined with evidence that these assets are increasingly being used to roll over loans to existing borrowers as well as being swapped between banks without a clear transfer of risk are alarming.”

Accounting for this financing, Chinese banks’ nonperforming loans could be three times higher than the official published level, he said.

By recording such lending under “investment receivables” rather than “loans” on their financial statements, banks were able to disguise what is in effect lending, to get around regulatory lending curbs or heavy reliance on wholesale funding. Such financial engineering also enabled some lenders to overstate their capital adequacy ratios, understate nonperforming loans and reduce provision charges, Bloomberg reported.

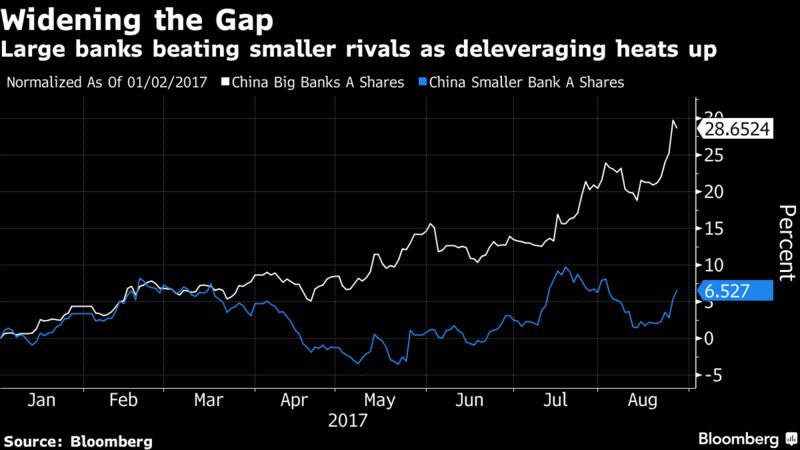

Authorities have renewed their campaign against financial leverage since the beginning of April to rein in risks associated with China’s $28 trillion debt pile, with a focus on unraveling interconnectedness among institutions and curbing shadow financing. Signs have emerged in recent months that smaller banks have been harder hit by the campaign and their shares have underperformed as a result.

Banks with high levels of shadow loans would be most exposed to any drastic regulatory changes that could lead to a surge in bad-debt recognition. The transfer of shadow credit into formal credit could cause borrowers to breach loan covenants and single borrower limits, eventually leading to “a significant recapitalization of a large swath of the banking sector,” Bedford wrote.

To be sure, the analyst isn’t expecting any sudden changes. He’s of the view that regulation combined with economic reforms, particularly of state-owned enterprises, and continued deleveraging are needed to reduce risks.

In that light, investors should be wary of banks with “material” shadow loan exposure, Bedford said. UBS recommends investors buy shares of Industrial & Commercial Bank of China Ltd. and China Construction Bank Corp. Shadow loans at both firms accounted for less than 1 percent of total assets at the end of 2016, according to Bedford’s report.

Asset Quality

Bank of Tangshan is an unlisted lender in the struggling northeast city of the same name, which produces more steel than any other city around the world. The firm’s shadow loans grew 86 percent last year to a size equal to 308 percent of its formal book, the highest of any bank in China, according to Bedford’s report.

Still, the bank reported a bad-loan ratio of just 0.05 percent last year, the lowest of any bank in UBS’ analysis, exemplifying the “distortion” shadow loan books create in assessing asset quality, Bedford said. Bank of Tangshan representatives didn’t respond to an email seeking comment.

Shadow loans can be used to circumvent regulations capping loans to a single borrower at 10 percent of a bank’s assets, or 15 percent in the case of a group company and its subsidiaries, according to Bedford. For example, he said that Baoshang Bank, an Inner Mongolia lender, has extended shadow loans equivalent to 126 percent of its net assets to one borrower.

Calls to Baoshang Bank’s general lines and board office in Baotou city weren’t answered.

Contagion Risk

Shadow-loan risk is most prevalent in China’s rust belt -- the once-proud steel and metal-producing provinces in the country’s northeast, which have declined in growthand importance as the government shifts its economic focus away from industrial output to the higher-end consumer and services industries.

“Shadow loans pose potential contagion risk between banks,” he said.