Following reports that North Korea tested a nuclear hydrogen bomb on Sunday, signs that Pyongyang may be preparing for the launch of an intercontinental ballistic missile escalated tensions in an already strained region. South Korea’s spy agency told lawmakers that there is possibility that the missile could be launched around North Korea’s national founding day on Sept. 9, or its party foundation day on Oct. 10, according to the Yonhap news agency.

According to Bloomberg, traditional havens such as the Swiss franc and yen led gains, followed by the Swedish krona and the euro. The common currency rose as traders sought safety after the London open and gained as much as half a percent to $1.1922, before paring gains and settling around $1.1900. The dollar was lower versus most of its Group-of-10 peers and down by 0.1 percent as measured by the Bloomberg index as of 10:14 a.m. New York time, holding close to the 2 1/2-year low touched on Aug. 29.

The greenback managed to pare losses versus the Japanese currency as it rebounded from a 109.23 day low, yet it never came near 110.25, the close on Friday, from which it gapped lower at the Asia open. The Swiss franc rose as much as one percent to 0.9554 per dollar as it erased its Friday drop.

Volumes were relatively muted as a U.S. public holiday on Monday and a plethora of central bank meetings due later this week kept most investors sidelined, according to Europe-based traders. Early demand from leveraged accounts for long volatility trades faded as the London session progressed, said the traders, who asked not to be identified as they weren’t authorized to speak publicly.

- With the ECB meeting on Thursday as the key scheduled event for the week, euro order books remain somewhat thin, with interest currently more concentrated around last week’s range extremes: traders

- Investors have stepped on the brake on fresh positions in euro-dollar as shown through realized volatility on the one-week tenor that hit its lowest level in three years on Monday

- DTCC data showed that demand for euro calls was almost double that for puts as upside exposure in the common currency came back in vogue

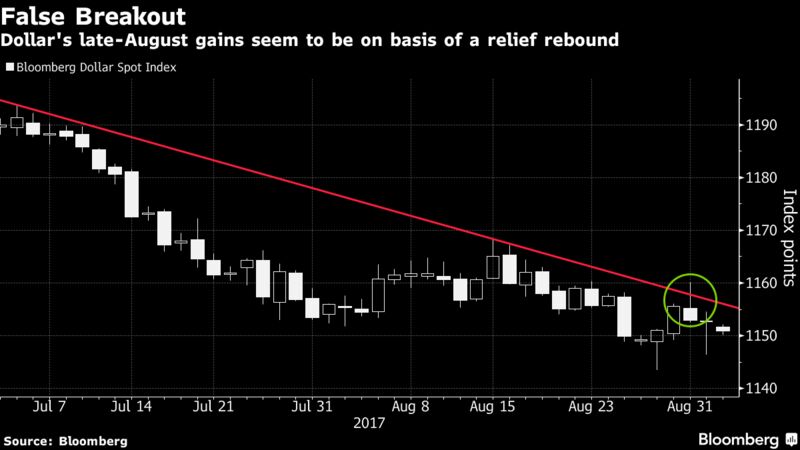

- The Bloomberg Dollar Spot Index was lower after a failed attempt to take on 21-DMA resistance on Aug. 31; in a sign that the latest rebound in the gauge was nothing more than a relief rally, the index remains firmly within its 2017 downtrend

- Market pricing of the probability of a Fed hike by year-end stood at 32% compared with 35% on Friday

- The Swedish krona pared its Friday losses as 8.00 handle caps yet again; Riksbank meets on Sept. 7 and investors look for a balanced approach by policy makers