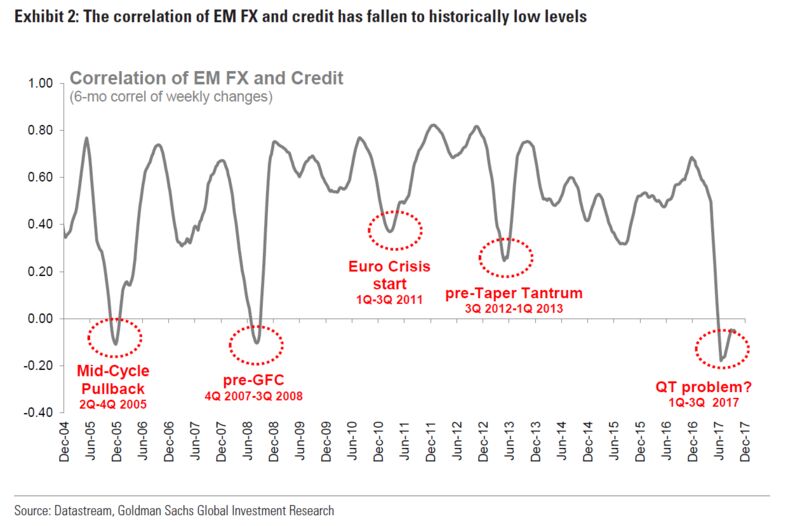

The correlation between emerging-market corporate credit in dollars and currencies has tumbled to a 15-year low over the past three months, according to an analysis by Goldman Sachs Group Inc., as bond buyers continue to choose riskier assets despite weakening foreign-exchange markets.

The MSCI Emerging Market Currency Index is more than 2 percent off its Sept. 8 peak, while corporate bond spreads are around 20 basis points tighter. The dislocation may provide ammunition for bulls given the credit cycle in both developed and emerging markets typically signals the direction for growth and other risk assets, Bloomberg reported.

“Our gut reaction is to put more weight into the credit markets than FX, given our positive fundamental views and the historical precedent that credit has often been more ‘right’ about inflections than EM FX,” Goldman Sachs strategist Caesar Maasry wrote in a note Thursday.

The Wall Street bank reckons emerging-market stocks are set to outperform bonds on a total-return basis, but still mostly likes developing-economy bonds and currencies amid the bullish global backdrop.

The resistance of some central banks to currency appreciation, combined with fears over global trade brinkmanship, undercut currencies in recent months, helping to account for the divergence, the strategist said.

“Directionally, EM credit is moving with global macro factors, which sets it apart from EM FX and provides further evidence that credit may be leading FX here and moving more in sync with macro fundamentals,” Maasry said.