The greenback edged lower against most major currencies as the disruption to federal services dragged into a third day. The euro climbed on optimism that German Chancellor Angela Merkel has made a potential breakthrough toward a fourth term. Traders monitored China’s appetite for a stronger currency as the yuan touched the symbolically key level of 6.4 per dollar. South Africa’s rand rose to its highest since 2015 on speculation President Jacob Zuma may be forced to leave office. U.S. stock futures fell, Bloomberg reported.

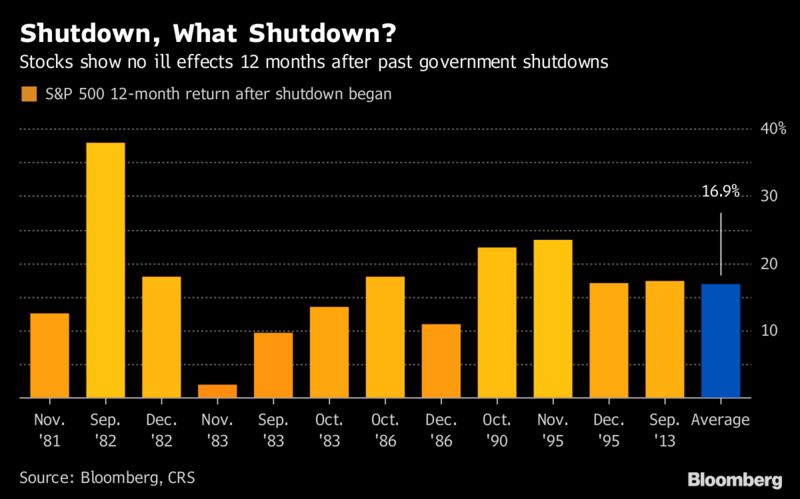

“Due to the limited economic impact, markets should be largely unaffected,” by the government shutdown, said Poul Kristensen, portfolio manager at New York Life Investment Management. “If there is a little pullback, we believe it will be a buying opportunity. The last time the government shut down in 2013, markets moved higher.”

Equity investors appear to have taken the latest U.S. government drama in their strideas the optimism over economic growth and profit increases that pushed many stock indexes to all-time highs lingers. Meanwhile, the next catalyst for bonds may come from commentary by policy makers after European and Japanese central bank decisions this week. Their signals that unprecedented stimulus will soon be wound back has sparked a surge in yields this month.

Elsewhere, West Texas oil edged lower, reversing earlier gains made after OPEC and Russia said output cuts will continue until the end of the year.

Here’s what to watch out for this week:

- Barring any last minute changes in Washington, President Donald Trump will join world leaders and senior executives in Davos, Switzerland, for the annual World Economic Forum.

- Central banks: Bank of Japan monetary policy decision and briefing on Tuesday; European Central Bank rate decision on Jan. 25

- U.K. Prime Minister Theresa May’s Brexit bill is set to be taken up in the House of Lords.

- Earnings season is in full swing: Netflix and Halliburton are due to post results Monday, with Novartis, General Electric, Intel, LVMH Moet Hennessy Louis Vuitton, Starbucks, Hyundai Motor and Fanuc Corp. coming later in the week.

And these are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index increased 0.1 percent as of 7:05 a.m. New York time to the highest in more than two years.

- The MSCI World Index of developed countries jumped 0.1 percent to the highest on record.

- The MSCI Asia Pacific Index increased 0.2 percent to the highest on record.

- Japan’s Nikkei 225 Stock Average advanced less than 0.05 percent.

- The MSCI Emerging Market Index rose 0.4 percent with its seventh consecutive advance.

- The U.K.’s FTSE 100 Index climbed less than 0.05 percent.

- Futures on the S&P 500 Index declined 0.1 percent.

Currencies

- The Bloomberg Dollar Spot Index decreased 0.2 percent to the lowest in about three years.

- The euro increased 0.3 percent to $1.2255.

- The British pound gained 0.4 percent to $1.3907, the strongest in 19 months.

- The Japanese yen advanced less than 0.05 percent to 110.72 per dollar.

Bonds

- The yield on 10-year Treasuries declined one basis point to 2.65 percent, the biggest drop in more than a week.

- Germany’s 10-year yield advanced two basis points to 0.58 percent, the highest in a week on the largest rise in more than a week.

- Britain’s 10-year yield advanced three basis points to 1.364 percent, the highest in more than 12 weeks on the biggest gain in more than a week.

Commodities

- West Texas Intermediate crude decreased 0.1 percent to $63.28 a barrel, the lowest in almost two weeks.

- Gold advanced 0.1 percent to $1,333.19 an ounce.