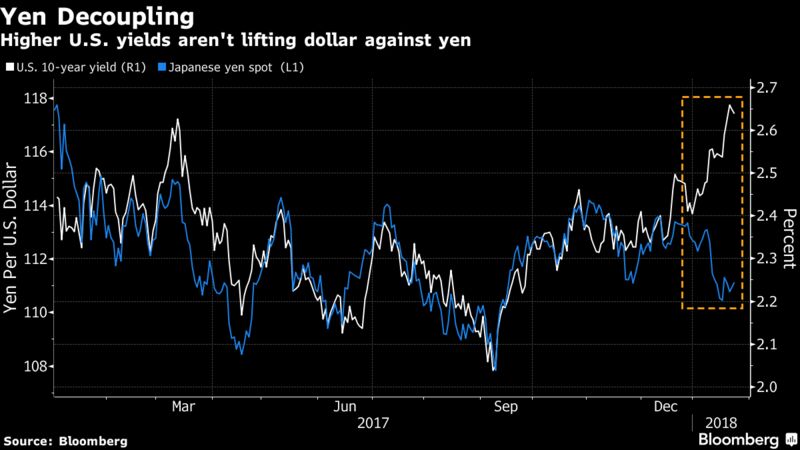

The dollar slid against almost all its major peers, taking its losing streak to three days as U.S. Treasury Secretary Steven Mnuchin said the decline provides a boost to the American economy through trade. The move happened even as the yield on 10-year Treasuries edged higher, tracked by those of most European government bonds as data showed the euro-area economy strengthened further at the start of 2018, according to Bloomberg.

As the euro gained the Stoxx Europe 600 Index fell, while emerging-market equities were little changed after eight days climbing. The record winning streak for Chinese stocks in Hong Kong continued. The pound jumped as U.K. employment rose and wage growth ticked higher.

Investors will now likely shift attention to Thursday’s European Central Bank meeting, while they keep an eye on Davos, Switzerland, where the world’s business and political elites have gathered for an annual conference that will feature the leaders of the U.S., U.K. and Germany among others. The dollar remains a key focus as traders increasingly cite concerns about a widening U.S. trade deficit that’s been highlighted by President Donald Trump’s protectionist moves.

“We’re looking for the dollar to continue to depreciate against most currencies,” Daniel Morris, a senior investment strategist with BNP Paribas Asset Management, said in an interview with Bloomberg Television. “The U.S. economy has a current-account deficit and it needs to close that -- one way to do that is for the dollar to depreciate.”

Meanwhile, on the back of the greenback’s weakness the yen pushed past 110 per dollar for the first time since September and South Africa’s rand traded below 12 per dollar for the first time since May 2015. Oil in New York paused its rally near the highest since December 2014 amid signs of a possible gain in U.S. crude stockpiles, and Bitcoin was trading at around $11,000.

Here’s what to watch out for this week:

- Earnings season is in full swing: General Electric, Intel, LVMH Moet Hennessy Louis Vuitton, Starbucks and Hyundai Motor all come this week.

- Barring any last minute changes in Washington, President Donald Trump will join world leaders and senior executives in Davos for the annual World Economic Forum.

- The European Central Bank announces its rate decision on Thursday

- The U.K. House of Lords is considering Prime Minister Theresa May’s Brexit bill this week.

These are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index declined 0.1 percent as of 9:43 a.m. London time, the first retreat in a week and the largest drop in more than a week.

- The MSCI All-Country World Index climbed 0.1 percent to the highest on record.

- The U.K.’s FTSE 100 Index sank 0.5 percent to the lowest in three weeks on the largest decrease in more than three weeks.

- Germany’s DAX Index sank 0.1 percent, the first retreat in a week.

- The MSCI Emerging Market Index fell less than 0.05 percent, the first retreat in almost two weeks.

- Futures on the S&P 500 Index gained 0.1 percent to the highest on record.

Currencies

- The Bloomberg Dollar Spot Index declined 0.5 percent to the lowest in more than three years.

- The euro advanced 0.4 percent to $1.2345, the strongest in more than three years.

- The British pound jumped 0.7 percent to $1.41, the strongest in 19 months.

- The Japanese yen jumped 0.6 percent to 109.60 per dollar, the strongest in more than 19 weeks.

- South Africa’s rand gained 0.7 percent to 11.9526 per dollar, the strongest in almost three years.

Bonds

- The yield on 10-year Treasuries advanced two basis points to 2.63 percent.

- Germany’s 10-year yield increased two basis points to 0.58 percent on the largest increase in almost two weeks.

- Britain’s 10-year yield jumped three basis points to 1.384 percent, the highest in three months.

Commodities

- Gold climbed 0.5 percent to $1,348.13 an ounce, the highest in almost 20 weeks.

- West Texas Intermediate crude fell less than 0.05 percent to $64.45 a barrel.