Haven assets including Treasuries and gold dropped with European debt, while the Stocks Europe 600 Index slipped as traders assessed the military action’s aftermath. The dollar weakened after futures data showed hedge funds are the most bearish on the currency in five years. WTI oil futures fell below $67 a barrel amid concern that shale production will rise further, and after there was no immediate reprisal to the missile attack. The ruble reversed earlier losses, Bloomberg reported.

“There was a significant fear of potential escalation; that hasn’t happened so far,” said Callum Henderson, a Eurasia Group managing director in Singapore. Even so, “it remains to be seen how long this market rally lasts on the back of this specific factor -- whether or not, or when, Russia retaliates,” he said on Bloomberg Television.

U.S. President Donald Trump declared “mission accomplished” via Twitter on Saturday, a day after the U.S., France and the U.K. launched military strikes in response to Syrian leader Bashar al-Assad’s suspected chemical attack on civilians. While geopolitical concerns linger, with new U.S. sanctions on Russia, the focus this week is back on earnings season in the U.S. and a slew of Federal Reserve officials who are due to speak, including the incoming head of the New York Fed, John Williams.

Aluminum resumed its rally, adding to what was its biggest weekly increase on record Friday. The yen edged up as polls showed falling support for Japanese Prime Minister Shinzo Abe’s government.

Here’s what to watch out for this week:

- Goldman Sachs Group Inc. and Morgan Stanley among companies reporting results

- John Williams, soon to be president of the New York Fed, speaks on economic outlook in Madrid on Tuesday.

- China GDP and Japanese inflation are the featured data points in Asia.

- Trump welcomes Japan Prime Minister Shinzo Abe to Mar-a-Lago on Tuesday. North Korea and trade will probably be discussed.

- Mining investors will get to take the pulse of the global industry this week, with Vale, Rio Tinto and BHP offering quarterly production reports.

Here are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index decreased 0.3 percent as of 7:42 a.m. New York time.

- The MSCI All-Country World Index was little changed.

- Futures on the S&P 500 Index gained 0.6 percent to the highest in almost four weeks.

- The U.K.’s FTSE 100 Index decreased 0.5 percent to the lowest in a week on the largest dip in more than three weeks.

Currencies

- The Bloomberg Dollar Spot Index declined 0.2 percent.

- The euro gained 0.3 percent to $1.2371, the strongest in almost three weeks on the biggest gain in a week.

- The British pound gained 0.6 percent to $1.4319, hitting the strongest in about 22 months with its seventh consecutive advance and the largest rise in more than a week.

- The Japanese yen climbed 0.1 percent to 107.26 per dollar.

- South Africa’s rand advanced less than 0.05 percent to 12.0681 per dollar.

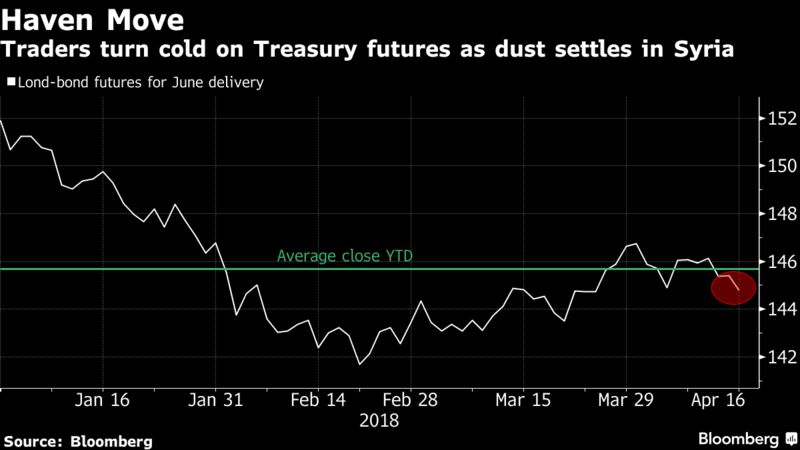

Bonds

- The yield on 10-year Treasuries climbed three basis points to 2.86 percent, the highest in almost four weeks.

- Britain’s 10-year yield increased four basis points to 1.455 percent, the highest in almost four weeks.

- Germany’s 10-year yield climbed three basis points to 0.54 percent, the highest in almost four weeks on the largest surge in almost six weeks.

Commodities

- Gold decreased 0.2 percent to $1,343.26 an ounce.

- West Texas Intermediate crude dipped 1.1 percent to $66.62 a barrel, the first retreat in more than a week.

- LME aluminum gained 2.4 percent to $2,340.50 per metric ton, the highest in more than six years.

- LME copper climbed 0.3 percent to $6,848.00 per metric ton.