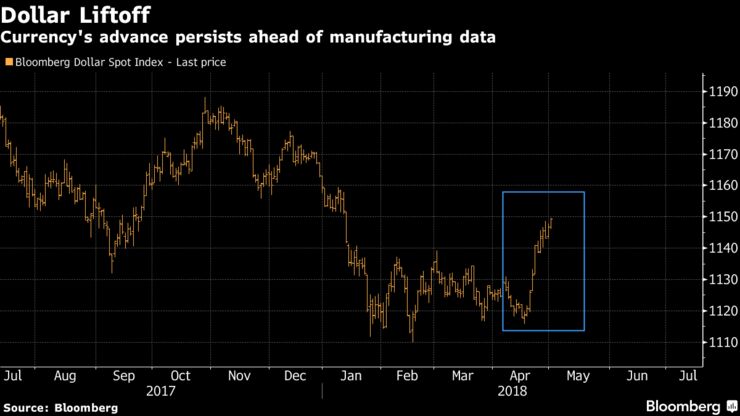

The S&P 500 Index declined Tuesday morning, pulled lower by financials and energy stocks. Ten-year Treasury yields held below 3 percent as the greenback headed for its ninth gain in 11 days, with that strength weighing on most commodities, Bloomberg reported.

The dollar got a boost from weakness across European currencies. Sterling slumped after U.K. manufacturing slowed more than predicted. That spurred the FTSE, one of the few European equity gauges trading, to rise a fourth day.

Markets were shut for holidays in countries including Germany, France, Italy, Spain, China, Hong Kong, Singapore and India.

For all the interest in company earnings, another big focus this week is likely to be central bank policy and economic data. Investors will watch the Federal Reserve meeting closely for any signals that policy makers will raise interest rates another three times this year. With the dollar ticking higher, foreign-exchange traders are also asking whether the U.S. currency’s bout of strength has legs or will fade as sellers emerge at key technical levels.

Elsewhere, West Texas oil retreated, erasing Monday’s gain. Gold fell again, heading for the lowest since December. The Australian dollar declined after the central bank maintained its policy stance amid below-target inflation and constrained household spending.

These are some key events to watch this week:

- The Federal Open Market Committee begins a two-day meeting on Tuesday. The rates decision is Wednesday.

- The European Commission presents its spring economic forecasts, which include projections for growth, inflation, debt and deficit.

- Payroll gains in the U.S. probably picked up in April, with the unemployment rate forecast to drop to 4 percent, according to surveys of economists.

- Earnings season continues, with Apple Inc. headlining. Other high profile results include Pfizer Inc., HSBC Holdings Inc. and Tesla Inc.

And these are the main moves in markets:

Stocks

- The S&P 500 Index declined 0.3 percent as of 9:34 a.m. New York time.

- The Nasdaq 100 Index fell 0.3 percent.

- The U.K.’s FTSE 100 Index rose 0.4 percent to the highest in almost three months.

- The MSCI Emerging Market Index decreased 0.4 percent.

Currencies

- The Bloomberg Dollar Spot Index increased 0.4 percent to the highest in almost 16 weeks.

- The euro declined 0.5 percent to $1.2019, the weakest in almost 16 weeks.

- The British pound fell 0.9 percent to $1.3635.

- The Japanese yen decreased 0.3 percent to 109.64 per dollar, the weakest in more than 12 weeks.

Bonds

- The yield on 10-year Treasuries increased less than one basis point to 2.95 percent.

- Britain’s 10-year yield fell two basis points to 1.398 percent, its sixth straight decline.

Commodities

- West Texas Intermediate crude fell 1.1 percent to $67.83 a barrel.

- Gold dropped 0.6 percent to $1,307.59 an ounce, the weakest in four months.

- LME copper fell 0.7 percent to $6,757.50 a metric ton.