Data released by Iranian Mines and Mining Industries Development and Renovation Organization also show the companies shipped 715,869 tons of steel during the fourth month of the fiscal year, Tir (June 22-July 22), which indicates a 21% YOY growth.

The data used here are the preliminary statistics released by IMIDRO on Iran’s top-scale producers and lack specifics on most private producers’ shipments.

A more detailed report is usually published by Iran Steel Producers Association in a few weeks, according to Financial Tribune.

Exports Hampered by Gov’t Restrictions, Sanctions Renewal

Steelmakers came into the year’s fourth month with the same laggard as in the previous month, namely the inability to utilize a weaker rial due to government restrictions.

This made exports less than desirable as they had to sell all their currency earnings to the government at an exchange rate half the value they could get on the free market.

On top of that, they were mandated to ramp up supply to Iran Mercantile Exchange to meet downstream users’ demands and sustain local steel products’ manufacture.

Last but not least, there was the issue of US sanctions reimposed on August 6. The performance in the third and fourth months shows that steelmakers had two approaches to the issue.

Those heavily reliant on exports, such as Khouzestan Steel Company, shipped as much as they could for the period before sanctions made exports too risky.

On the other hand, those mostly reliant on the local market, such as Esfahan and Mobarakeh steel companies, seem to have gradually cut back on exports to prepare for a new normal. Whether they can keep up shipments during the sanctions period–like they did in the previous round of US sanctions–is still up in the air.

Khouzestan Steel Ramps Up Shipments

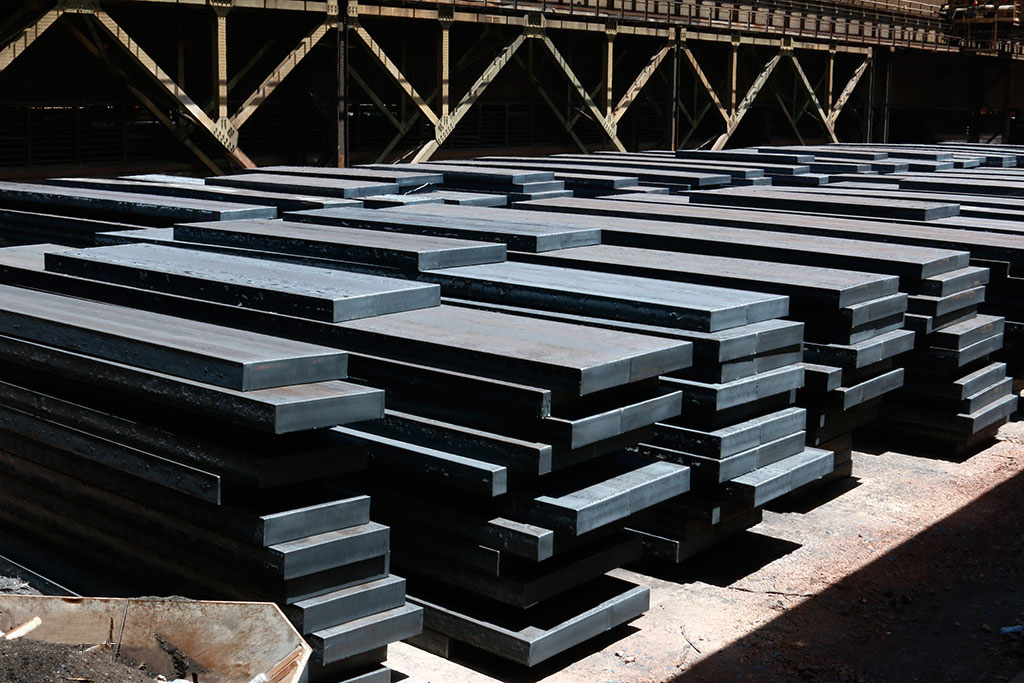

Khouzestan Steel Company exported 959,008 tons of slab, bloom and billet in the four-month period, registering a 13% growth YOY, and staying at the top of the chart.

Slab exports had the lion’s share of KSC’s exports with 405,458 tons, going up 42% YOY. Billet exports came next with 280,837 tons up 120% YOY, followed by bloom with 272,713 tons, down 47% YOY.

In stark contrast to Q1, KSC’s Tir performance highlights its strong return to the exports front, just a month before sanctions hit Iran. Its shipments for the month grew 68% to 194,712 tons. Billet exports surged 291% to 80,543 tons, bloom dropped 13% to 61,123 tons and slab jumped 112% to 53,046 tons.

As a company that heavily relies on exports, it had to ramp up shipments before it lost all footholds in foreign markets.

The steelmaker, located in the southwestern Khuzestan Province, exports to over a dozen countries. About half of the exports go to the Middle East and North Africa region. Other major export destinations are located in the Far East and Americas.

KSC exported a record high of 2.76 million tons last fiscal year (March 21, 2017-18), growing 34% YOY.

Mobarakeh Retreats From Exports

Mobarakeh Steel Company’s U-turn in Tir also highlights another side of large steelmakers’ reaction to sanctions.

MSC’s exports for the four months are still up, although on a much smaller scale compared to the month before.

Shipments amounted to 459,613 tons for the four-month period, up 58% YOY. The downturn compared to Q1 can be clearly witnessed in key commodities. For instance, hot-rolled coil shipments were up 171% to 227,639 tons, while Q1 saw it grow 992%. Furthermore, prepainted coils were down 58% to 724 tons, compared to Q1’s 19% growth.

Tir performance underlines the same narrative, as exports registered zero change YOY and stood at 117,512 tons. The only commodity growing was slab, up 13% to 46,564 tons, while HRC, cold-rolled coil, prepainted coils and galvanized sheets were all down in double digits.

This is a drastic change month-on-month, as the third month of the year saw shipments surge 200% YOY.

Yet this is understandable, as MSC seems to be turning its gaze inward at local market as exports become more risky.

MSC was last year’s second largest exporter with 1.292 million tons of shipments. Together with its subsidiaries, Mobarakeh Steel is the largest flat producer in the Middle East and North Africa region, accounting for 1% of Iran’s GDP.

Hormozgan Steel Overtakes ESCO

With a narrow lead, Hormozgan Steel Company became the period’s third largest exporter with 373,549 tons of slabs, up 5% YOY. Its Tir performance was in line with the market narrative, as it inched down 1% to 184,867 tons.

Esfahan Steel Company came next with 369,604 tons for the four months. The 22% YOY downtick seems to be what dropped it to fourth place.

Rebar made up 61,980 tons of ESCO’s overall exports in Q1, dropping 4% YOY. It was followed by beam and coil with 35,176 tons and 19,962 tons respectively. Beam shipments were down 22% YOY, while coil exports grew 17%. Steel products listed as “other” made up 252,486 tons of all the exports, down 28% YOY.

ESCO’s Tir performance was similar to MSC, as shipments remained unchanged YOY to 114,995 tons. The veteran steelmaker also seems to be refocusing on domestic demand while monitoring the impact of sanctions.

ESCO ended last year with an 80% uptick in exports to 1.15 million tons, making it the third largest exporter.

Other Producers

South Kaveh Steel Company came next with 303,000 tons of billets to post a 63% YOY upsurge in four-month shipments.

Khorasan Steel Company took the next spot with 46,874 tons of bloom and 28,823 tons of billets. It was followed by Iran Alloy Steel Company with 30,322 tons of billet and Khouzestan Oxin Steel Company with 12,868 tons of plates.