"Issuing insurance security is being pursued as a financing instrument for the insurance sector and after five meetings with the Securities and Exchange Organization and its Islamic Jurisprudence Committee, the measure was finally approved," Gholamreza Soleimani Amiri said.

The official said that the bonds are expected to be issued before the yearend in March.

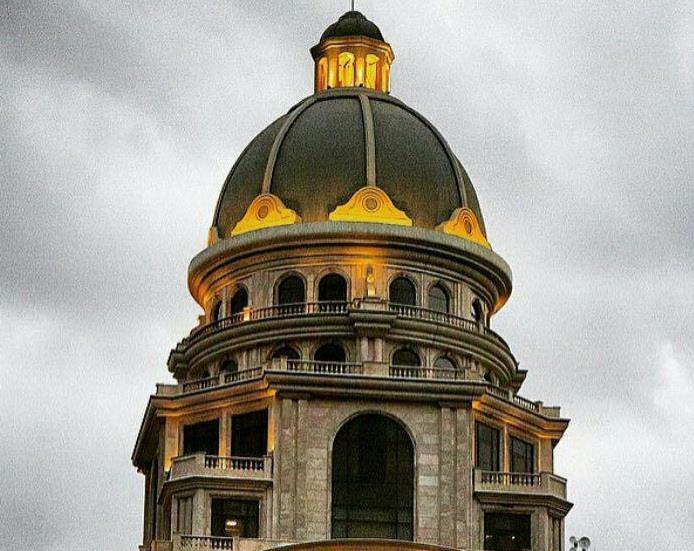

The fifth edition of the International Exhibition of Exchange, Banking, Insurance and Privatization, held in parallel with the 10th edition of the Exhibition on Iran’s Investment Opportunities, otherwise known as Kish Invex 2018, opened Monday at Kish International Exhibition Center. Kish Invex is the biggest economic event organized by the private sector in Iran, bringing together stakeholders in key sectors, namely banking, insurance, bourse, energy, construction and infrastructure, transport, tourism, logistics, free trade zones and managers of projects open to investments, according to the official website of the event, Financial Tribune reported.

Soleimani Amiri said the insurance industry needs a financial stability committee so that it can manage to bring enough balance for insurance partners. The share of non-mandatory insurance has grown to 15% from 9% during the first half of the current fiscal (March-September), he said.

The senior insurance official noted that investment in the domestic insurance sector has registered decent growth in recent years but still has room for improvement. Life insurance has a 16% share of Iran’s overall insurance sector, while the figure is 55% in the world.

Soleimani Amiri said the insurance industry can utilize blockchain technology regarding "smart contracts" and there are plans to regulate startups in the insurance industry.

He noted that one of the procedures now at work in CII is the promotion of private companies so that there is “no government-owned company left.”

As the nation moves toward downsizing, state and government-owned insurance companies would do better if they embark on the road to privatization, he said.

The list of companies not authorized to sell third party insurance policies will be issued by end of next month.

Iran’s insurance industry earned 183 trillion rials ($1.28 billion) from premiums during the first six months of the current fiscal. According to CII data, the figure shows a growth rate of 25.4% compared to the same period last year. The CII, as the only state-owned insurer, had a 32.3% share in the earnings, well above other insurers and the rest belonged to private companies.