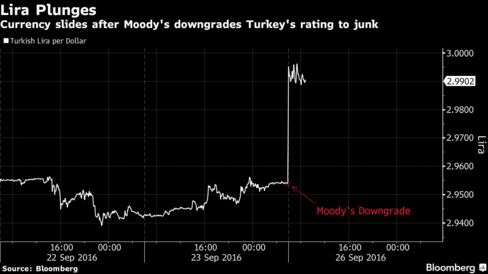

Turkey’s stock index dropped the most since July 21 and the lira slid to the weakest level in seven weeks as Moody’s cited rising risks related to Turkey’s external financing needs and weakening credit fundamentals, a decision which followed a downgrade by S&P Global Ratings in July. The Philippine peso hit a seven-year low on concern about the policies of President Rodrigo Duterte. Currencies and stocks in developing countries fell for a second day before OPEC members and other producers meet Wednesday amidindications Saudi Arabia may agree to cut output to January levels, reports Bloomberg.

Developing-nation assets are retreating after posting their biggest weekly gains since July. Friday’s plunge in oil prices jolted investor sentiment, which had been improving after accommodative monetary policy from the Federal Reserve and the Bank of Japan last week rekindled demand for riskier assets. Recent gains sent valuations in the MSCI Emerging Markets Index to near the highest level since 2010.

“We are seeing some correction on profit taking by those investors who accumulated before the Fed meeting last week,” Rafael Palma Gil, a Manila-based trader at Rizal Commercial Banking Corp. “The Fed will eventually raise interest rates, so the overhang is still there and that’s partly driving the weakness.”

The MSCI Emerging Markets Currency Index dropped 0.2 percent as of 3:20 p.m. in Hong Kong. The lira sank 0.7 percent, extending its decline in the past two days to 1.6 percent, according to data compiled by Bloomberg. That took losses to about 40 percent against the dollar since 2013, when the U.S. Federal Reserve said it was phasing out its extraordinary monetary stimulus program, raising the prospect of reduced investment flows to emerging markets such as Turkey.

“The risk of a sudden, disruptive reversal in foreign capital flows, a more rapid fall in reserves and, in a worst-case scenario, a balance of payments crisis has increased,” Moody’s said in an e-mailed statement announcing the decision late Friday.“This slow deterioration in Turkey’s credit profile will continue over the next two to three years and the balance of risks are better captured at a Ba1 rating level.”

Turkey’s rating was cut from Baa3, leaving Fitch Ratings as the only major ratings company to keep Turkey at investment grade.

“The lira weakened as expected, but the drop is not really significant as the market already saw it coming previously with S&P’s cut,” said Wu Mingze, a foreign-exchange trader in Singapore at INTL FCStone Inc., a Nasdaq-listed global payments-service provider. “If the OPEC meeting manages to have any sort of consensus plan, it will be great for market confidence.”

Malaysia’s ringgit declined 0.5 percent per dollar, after a 3.7 percent slide in Brent crude Friday weighed on the outlook for the net oil exporter’s finances. South Korea’s won declined 0.5 percent and Taiwan’s dollar retreated 0.3 percent.

“For Asian currencies, market focus is going to be on the U.S. presidential debates starting later today,” said Divya Devesh, a foreign-exchange strategist at Standard Chartered Plc in Singapore. “Markets seem to be adopting a slightly cautious tone heading into the debates on fears of risk aversion.”

Philippine Selloff

The Philippine peso weakened 0.5 percent and reached 48.260, the lowest since September 2009. S&P Global Ratings warned last week of “rising uncertainties surrounding the stability, predictability, and accountability” of the president’s administration.

Global funds sold Philippine stocks for a 22nd straight day amid nervousness about the fallout from Duterte’s anti-drug war and his outbursts against the U.S. and the United Nations.

China’s 10-year government bonds rose, pushing the yield down three basis points to 2.72 percent, the lowest since Aug. 26. The yield on similar-maturity notes in South Korea was steady at 1.50 percent.

Philippines’ 10-year yield surged 37 basis points to 3.94 percent, the highest since mid-July, according to the midday fixing from Philippine Dealing and Exchange Corp. Malaysia’s 10-year yield rose three basis points to 3.60 percent and Indonesia’s yield advanced four basis points to 6.91 percent.

Stocks

The MSCI Emerging Markets Index declined 1.1 percent, poised to pare a monthly gain of 1.5 percent. All 11 industry groups dropped, paced by industrial and technology companies. Taiwan Semiconductor Manufacturing Co., which makes chips for Apple Inc., dropped 2.4 percent, the biggest drag on the regional gauge.

The Taiwanese stock led shares of suppliers lower on concern of slower iPhone 7 sales. Apple slid on Friday amid speculation that German research firm GfK issued a report suggesting iPhone 7 sales would be lower than last year, based on data in Europe and Asia.

Taiwan’s Taiex index declined 1 percent, retreating from the highest close since July 2015. The Hang Seng China Enterprises Index of mainland shares traded in Hong Kong dropped 1.6 percent, its second day of losses, while the Shanghai Composite Index declined 1.8 percent. Philippines stocks sank 1.2 percent, while equity measures in India and Indonesia lost at least 0.8 percent.