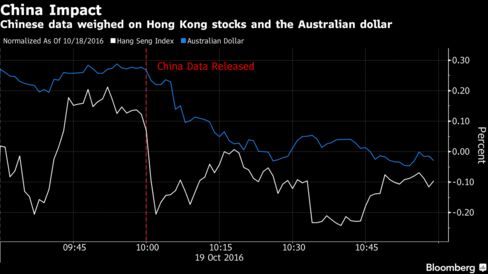

According to Bloomberg, West Texas Intermediate crude climbed for a second day after industry data showed U.S. stockpiles declined and Saudi Arabia’s Minister of Energy and Industry Khalid Al-Falih said many nations are willing to join OPEC in cutting production. The MSCI All Country World Index of shares was little changed after rallying in the last session by the most in almost a month. Stocks in Hong Kong swung to a loss and the Australian dollar temporarily erased gains after an unexpected slowdown in China’s industrial output cast a cloud over gross domestic product figures that matched analyst estimates. Saudi Arabia may price its debut dollar-denominated bonds on Wednesday.

Crude has gained 18 percent in the past month, prompting concern that inflation will accelerate around the world and bolstering the case for the Federal Reserve to make its first interest-rate hike since December. Reports Tuesday showed the cost of living in the U.S. rose at the fastest pace in five months, while in the U.K., a weaker pound has also helped push the price of goods higher. Longer-maturity bonds are the victims, with Treasury 30-year bonds tumbling more than 3.5 percent in October.

“Oil has rallied quite strongly over the past month -- it’s not only due to OPEC,” Jens Naervig Pedersen, an analyst at Danske Bank A/S, said by phone. “The market is still figuring out whether there is a more persistent downtrend” in U.S. stockpiles, he said.

Commodities

West Texas Intermediate crude gained 1.5 percent to $51.06 a barrel as of 10:48 a.m. London time, while Brent added the same amount to $52.47.

U.S. crude inventories dropped by 3.8 million barrels last week, the American Petroleum Institute was said to report. Government data Wednesday is forecast to show stockpiles rose. There is no possibility Russia will pull out of an agreement to cut production, OPEC Secretary-General Mohammed Barkindo told reporters at a conference in London.

Natural gas for day-ahead delivery in the U.K. continued a record run of gains with below-average temperatures forecast and as the highest coal price in at least two years, reached Tuesday, boosted the incentive to use gas in power generation. The price climbed 0.4 percent to 45.2 pence a therm.

Aluminum fell 1.1 percent to $1,624 a metric ton after China’s output surged in September to its highest in fifteen months as new and idled plants were fired up, threatening to undo this year’s rally in prices.

Gold added 0.3 percent to $1,266.83 an ounce, climbing for a third day as the dollar weakens amid speculation the Fed will look past the pickup in inflation and stick to a gradual tightening of monetary policy even if it raises interest rates this year. Nickel dropped 1.3 percent and copper lost 0.3 percent.

Stocks

The Stoxx Europe 600 Index fell 0.2 percent, with most industry groups down, as investors focused more on Thursday’s European Central Bank meeting than a slew of largely-positive earnings reports.

Among European stocks moving on corporate news today:

- Reckitt Benckiser Group Plc declined 2.1 percent after the maker of Durex condoms and Nurofen painkillers reported disappointing third-quarter sales.

- ASML Holding NV advanced 2.8 percent after Europe’s largest semiconductor-equipment maker forecast fourth-quarter profitability above analysts’ estimates.

- Travis Perkins Plc slid 7 percent after forecasting full-year adjusted earnings below consensus estimates.

- Carrefour SA rose 2 percent after France’s biggest retailer reported third-quarter revenue that beat forecasts on stronger-than-expected growth in its home country.

- Banca Monte dei Paschi di Siena SpA surged 5.8 percent after the Italian lender said it’s pressing ahead with a plan to bolster capital and sell soured loans.

The MSCI Emerging Markets Index added 0.4 percent, following a 1.6 percent jump on Tuesday.

The Hang Seng China Enterprises Index of mainland companies listed in Hong Kong retreated 0.8 percent and the Shanghai Composite Index ended the day little changed after a report showed industrial output rose 6.1 percent, less than the median forecast for a 6.4 percent gain. China’s gross domestic product expanded 6.7 percent in the last quarter from a year earlier, the third straight period at that pace.

S&P 500 Index futures were little changed. As well as data on housing starts, investors will also look Wednesday to the Fed’s Beige Book survey of regional conditions for clues on the health of the world’s biggest economy. Earnings are also in focus, with Morgan Stanley scheduled to report Wednesday.

Intel Corp. fell 4.9 percent in premarket New York trading after it gave a disappointing forecast for sales in the current quarter. Yahoo! Inc. added 0.8 percent after reportingthird-quarter profit that topped estimates, even as revenue fell short.

Currencies

The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major peers, slipped 0.2 percent after losing 0.5 percent over the last two days. Russia’s ruble strengthened 0.5 percent and the Mexican peso climbed 0.2 percent.

A U.S. presidential debate Wednesday comes as opinion polls point to a growing likelihood that Democratic nominee Hillary Clinton will beat Republican rival Donald Trump in next month’s vote. Canada’s central bank is due to make a rate decision today, with analysts surveyed by Bloomberg anticipating it will keep its main interest rate at 0.5 percent.

Australia’s dollar was gained 0.2 percent, after earlier fluctuating on the data out of China. New Zealand’s dollar pushed up 0.3 percent.

The MSCI Emerging Markets Currency Index rose 0.3 percent, after gaining 0.4 percent on Tuesday.

Bonds

Bond investors’ outlook for worldwide inflation is close to the highest level in 14 months, based on Bank of America Corp. data. The figure, derived by comparing yields on nominal government securities to those on inflation-linked debt, is at 1.37 percentage points, after reaching 1.39 percentage points earlier this month.

The yield on U.S. Treasuries due in a decade was little changed at 1.74 percent. It fell three basis points on Tuesday. The probability of the Fed hiking interest rates this year slipped by three percentage points in the last session to 63 percent, futures prices indicate.

U.K. government bonds climbed after a sale of 2.5 billion pounds ($3.1 billion) of gilts maturing in 2026. The 10-year yield slipped two basis points to 1.06 percent.

Saudi Arabia aims to sell notes due in five years for about 160 basis points over similar maturity U.S. Treasuries, 10-year notes at a spread of 185 basis points and 30-year securities at 235 basis points, according to people familiar with the matter.