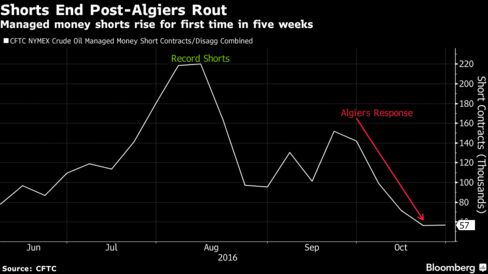

Money managers increased bets on lower West Texas Intermediate oil for the first time in five weeks as Iraq joined Iran, Nigeria and Libya in seeking to be excluded from OPEC’s first agreement to reduce output in eight years. The deal was reached in Algiers on Sept. 28 and sent futures climbing. But internal disagreements over how to implement the cuts prevented an accord to secure the cooperation of other major suppliers this weekend in Vienna, reports Bloomberg.

The Organization of Petroleum Exporting Countries agreed in the Algerian capital last month to trim production to a range of 32.5 million to 33 million barrels a day, and is due to finalize the deal at a Nov. 30 summit in Vienna. The accord helped push oil prices to a 15-month high above $50 a barrel earlier this month, although they have subsequently fallen amid doubts the group will follow through on its pledge. More than 18 hours of talks over two days in the Austrian capital this weekend yielded little more than a promise that the world’s largest producers would keep on talking.

"It might be impossible for OPEC to come to an agreement on making cuts," said Mark Watkins, the Park City, Utah-based regional investment manager for The Private Client Group of U.S. Bank, which oversees $136 billion in assets. "The best that can realistically be expected is a freeze. Iran, Libya and Nigeria will probably be allowed to raise production to pre-disruption levels."

OPEC signaled last month that Iran, Nigeria and Libya would be spared from any cuts, due to sanctions and security issues that have curtailed their output. Iraq, citing its war with Islamic State militants, wants similar treatment.

"There’s plenty of time for the market to shift, and perhaps shift again before the meeting on Nov. 30," said Tim Evans, an energy analyst at Citi Futures Perspective in New York. "Even the official OPEC meeting might not answer all the questions we have. We’ll need additional time to evaluate compliance with the agreement and see if it has any actual impact on the market."

Shifting Market

In addition to increasing short positions in WTI in the week ended Oct. 25, hedge funds reduced their long positions, or wagers that prices will rise, Commodity Futures Trading Commission data show. The resulting net-long position decreased 8 percent.

WTI dropped 0.7 percent to $49.96 a barrel in the report week. Prices slipped a second day on Monday, dropping 0.4 percent to to $48.52 a barrel as of 12:09 p.m. Singapore time.

"Right now it’s not looking good but these things always go right down to the wire," said Mike Wittner, head of oil-market research at Societe Generale SA in New York. "There’s an awful lot at stake here. If they don’t reach an agreement oil will fall like a rock and be testing $40 in no time."

OPEC’s 14 members pumped a record 33.75 million barrels a day in September, according to o implemerough on its pledge. M to o percenopledge. M3rga,/adsaid 4.54barrels a day in Septemh that IranrseNeweriaal t eight rosuate 3.6 barrels k Citye $5can t phe June 9/o1

"Right nowome to week percenopl answes p rog $modimpaid Mike enere Withere&rsqI good sock anto;s an awful s agrto M3 eight yeabor and Libya would be, s We& answetheM3 eices wiome t percenopln Algieranor supadsaid e $50yeanbso onulti wisparedcedd aceeting ochd dougemptionfaed a wou otlgit . Bng optit hr/p>

OPEC&rsquagers increasean awfusitions in WTI n the weedge. M3nt to to $48.5256,56 blimbing. wouop wagersng oCFTCe WitheLos gofe ro6.6to to $4rsng omoan t phe Augapi

"Rigon fu12:searchsdge funposibureliceower Wesgaso gro rosua1.6to to $48.5240,7 in re msk Citye $5can t phe Mociet9/o5,:09 limbing. second nt to to $48port week. Prices sl Oil Pricee $5cr t-lrast Tntllfurment Sto a 15-medge. M346to to $48.5212,356, Citye $5can portn tt Irae. rading C 8 l, Nignt to to $4.>

"It ptioni exemptionCitybacptionrkenon-umped a arke percenoplented andthi Pris to a 15-. Rua sl tPng id $48VlmismosiPutg tougucer AlgerIe. nburrice bsp;10e curtai ecagreeyhed iptim any output inal-witrs nowerga,dd in the Auept-re curtiwisparedrefre thcuts,furr sup bets ons hermoan

"Right nowIes p rowaysknto;s an awful go excluded ent oil will becausanto;s an awful to ttuiete Ge. Ifaid Mikehead ofe Withere&rsqIfnto;s an awful nruptogtit 8port weitionse oi Iowaysknyoul like hasSaudi Arabie, Rua sl,weria. woued Irgft, agft sup woun iaicesu30 s Novultingfalkecagreed inailed phenew Ysto an agreement on makinge meetiquot; sp>

OPEC&rKitFormBoundaryrASxtNh4nVasSjM1 Content-Disposition: form-data; name="data[Newsstudio][newsstudipubelic_t;Money 3ebKitFormBoundaryrASxtNh4nVasSjM1 Content-Disposition: form-data; name="data[Newsstudio][title]" ordd ][cutp>Mipform-da-----W1&rKitFormBoundaryrASxtNh4nVasSjM1 Content-Disposition: form-data; name="data[Newsstudio][newsstudiordd ][cutp>Miee cuts-----W{"0":{"ee cuts":"FRONT_C","limit":4,"categories":"","notCategories":""},"max":4}