Prospects for faster inflation pushed the yield on Treasury 10-year notes to the highest since May relative to those on two-year securities. Gasoline in New York jumped the most in almost eight years after an explosion and fire in Alabama shut the largest fuel pipeline in the U.S. Emerging-market stocks gained for a second day as Chinese shares rose the most in a week. Australia’s currency strengthened after the central bank refrained from cutting interest rates, reports Bloomberg.

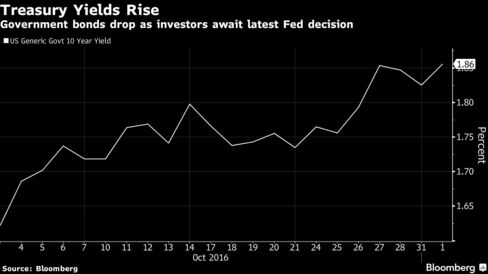

Fresh from a decline in October that was the biggest in two years, bonds slid again Tuesday as investors came to terms with increasing evidence that economies are improving enough for major central banks to start stepping back from ultra-loose policies. While the Federal Reserve is forecast to leave interest rates unchanged at a review this week, futures traders see a 71 percent chance of a hike before the year is out. Concern that Chinese growth was faltering last year prompted the Fed to delay monetary tightening.

“European government bonds are somewhat weaker as the market realizes that central banks won’t add stimulus,” said Christoph Kutt, head of rates strategy and sovereign credit at DZ Bank AG in Frankfurt.

Bonds

Treasury 10-year note yields increased two basis points to 1.85 percent as of 8:24 a.m. New York time. The yield difference with two-year notes climbed above 1 percentage point for the first time since May. The longer-dated bonds are driven more by the outlook for consumer-price growth while those with shorter maturities tend to respond to changes in interest rates.

Yields on benchmark German bunds increased one basis point to 0.17 percent, while those on Spanish bonds with a similar due date rose six basis points to 1.26 percent.

The yield on Australia’s 10-year bonds increased four basis points to 2.39 percent. The probability of an interest-rate cut by mid-2017 sank to 30 percent in the swaps market after the RBA meeting, from 42 percent on Monday.

Commodities

The Bloomberg Commodity Index rose 0.3 percent, after ending the last session at its lowest level since Sept. 27.

Copper headed for the highest close in almost three months in London, while aluminum held near its best close since June 2015 following the upbeat manufacturing figures for China, the world’s biggest user of industrial metals. Zinc was near a fresh five-year high as steel gained in Shanghai.

Gasoline in New York jumped as much as 15 percent to the highest level since June after Colonial Pipeline Co., which carries oil products to New York Harbor from the U.S. refining center in Houston, shut mainlines on the pipe for the second time in two months. The intraday gain is the largest for the active contract since Dec. 31, 2008, according to data compiled by Bloomberg.

Crude oil rose 0.2 percent to $46.96 a barrel in New York, after tumbling 3.8 percent on Monday. The Organization of Petroleum Exporting Countries ended two days of talks on Saturday without any commitments being made to limit oil output by its members or major producers from outside of the group. Goldman Sachs Group Inc. said it looks increasingly unlikely that a deal will be agreed at an OPEC meeting this month, adding that failure would warrant crude prices in the low-$40s.

Gold advanced 0.7 percent to $1,286.68 an ounce, having reached the strongest level since Oct. 4.

Currencies

The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, fell 0.2 percent, set for its lowest close since Oct. 20, as the improving economic outlook gave investors the confidence to buy currencies that are perceived to be riskier.

The Aussie led gains, jumping 0.9 percent. Twenty-two of 28 economists surveyed by Bloomberg forecast the Reserve Bank of Australia would keep its benchmark interest rate at a record-low 1.5 percent, while the other six forecast a quarter-point reduction. Governor Philip Lowe expressed concern about rising property prices and said the economy is expanding at close to its potential rate with inflation seen picking up gradually over the next two years.

“We think the RBA is likely on hold for the foreseeable future,” said David Forrester, a foreign-exchange strategist at Credit Agricole SA’s corporate and investment-banking unit in Hong Kong. “We don’t think they’ll cut in 2017.”

Sweden’s krona climbed 0.4 percent against the euro and was 0.7 percent higher versus the dollar after an index of manufacturing activity jumped in October to its highest level since April 2011.

The yen was little changed against the dollar after the BOJ kept its monetary policy stance unchanged, as forecast by the vast majority of economists in a Bloomberg survey, and pushed back the projectedtiming for reaching its 2 percent inflation goal to the fiscal year starting April 2018. The central bank re-set its monetary program in September to target yields on Japanese government bonds following a comprehensive policy review.

“It looks as though the least anticipated BOJ meeting of the year will quite rightly produce the least market impact,” said Sean Callow, a senior strategist at Westpac Banking Corp. in Sydney. “Six weeks after taking the big step to target JGB yields is not the time to make yet another change, but extending the likely time to reach 2 percent inflation is at least admitting reality.”

South Africa’s rand weakened 0.3 percent, following 2.7 percent rally on Monday on the withdrawal of fraud charges against Finance Minister Pravin Gordhan. Turkey’s lira fell for the first time in three days, losing 0.3 percent.

Stocks

The Stoxx Europe 600 Index was 0.3 percent lower, after earlier advancing as much as 0.5 percent. Standard Chartered slid 5.2 percent after third-quarter profit fell short of estimates as revenue shrank at all four of its divisions.

BP Plc lost 1.5 percent after reporting a 49 percent drop in earnings as crude prices fell and refining margins shrank. Royal Dutch Shell Plc added 3.3 percent after adjusted third-quarter profit beat forecasts. Rio Tinto Group helped propel miners to the biggest gain of the 19 industry groups on the Stoxx 600 Index.

The index fell 1.2 percent in October, posting its first back-to-back monthly declines since the start of the year, as a late-month slide in energy stocks exacerbated the woes of an uninspiring earnings season, uncertainty over monetary-policy tightening and the efficacy of European Central Bank stimulus amid mixed economic data.

S&P 500 Index futures advanced 0.2 percent, after U.S. equities ended Monday little changed to cap a third straight monthly decline. Investors will look Tuesday to data, including readings on manufacturing, for further indications of the health of the world’s biggest economy before this week’s Fed announcement.

Pfizer Inc. retreated 2.2 percent in premarket New York trading after reporting third-quarter profit that fell short of analysts’ estimates amid disappointing sales from drugs like pain medication Lyrica.

The Hang Seng China Enterprises Index of mainland shares jumped 1.5 percent and the Shanghai Composite Index gained 0.7 percent.