As pro-Kurdish party leaders were detained amid a crackdown against President Recep Tayyip Erdogan’s opponents Friday, the currency extended the worst three-month slump in emerging markets to an all-time low, and the country’s 10-year yields climbed to the highest of any developing economy outside Latin America. With political risk now exceeding South Africa and Brazil, investors should be wary of looking for bargains too early, according to Abbas Ameli-Renani of Amundi Asset Management.

"I view Turkey as the only country among the emerging-market majors yet to have undergone a trough in its political cycle, even after the failed coup attempt in mid-year," said Ameli-Renani, a London-based global emerging-market strategist at Amundi, which manages more than $1 trillion. "Ultimately, we are witnessing a gradual but clear deterioration in the quality of Turkish institutions and governability factors," he said, declining to disclose his recommendations on the country.

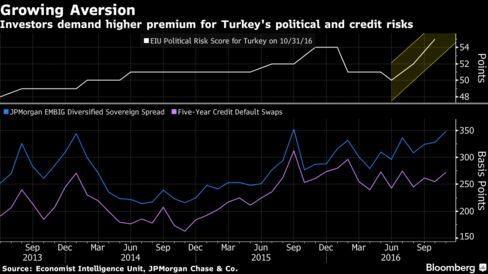

According to Bloomberg, investors are finding it increasingly hard to ignore Turkey’s political strife, even though many have become open to accepting more volatility to boost returns. More than 100,000 people have been fired, suspended or detained since the nation declared a state of emergency in July. While Turkish 10-year bonds offer yields around six times their U.S. equivalents, political risk in the country is at its highest in 13 years, according to an index compiled by the Economist Intelligence Unit.

As the currency, which weakened to a record 3.1741 per dollar, lost 1.5 percent by the close Friday, the stock market fell the most in the world, declining more than 3 percent to its lowest level since July. Yields on 10-year government bonds rose the most in more than a month to 10.38 percent. Similar-maturity debt in South Africa yields 8.69 percent while Brazilian notes offer 11.52 percent.

Turkish assets regained some poise on Monday, with 10-year yields falling seven basis points while stocks gained 1.6 percent. The lira advanced almost 0.2 percent against the dollar as of 11:26 a.m. in Istanbul.

Crackdown

Eleven members of parliament including the co-chairs of the Peoples’ Democratic Party, or HDP, were detained on Friday. S&P Global Inc. sees Turkey’s state of emergency remaining until at least January.

“It will get worse and worse as democracy is faltering in that country,” said Cristian Maggio, the head of emerging-market research at TD Securities in London, who sees the lira depreciating to 3.40 per dollar by the end of next year. “Investors invest in authoritarian regimes that were already so, not the ones that U-turn on democracy.”

The political backdrop adds to a litany of economic headaches for the country, including above-target inflation and a slump in tourism following a series of terrorist bombings across the country. Turkey depends on international investors to help finance a current-account deficit that will widen to almost 5 percent of output next year, according to a Bloomberg survey of analysts. Both Moody’s Investors Service and S&P assign junk status to the country’s debt.

Excessive Pessimism

Even with so many clouds hanging over the country’s outlook, investor pessimism may be overdone, according to Koon Chow, a strategist at Union Bancaire Privee Ubp SA in London.

"If, hypothetically, political uncertainty eases a bit or growth turns out to be more resilient, asset prices could bounce to correct some of the deep discount that we currently have on Turkish assets,” Chow said.

For Societe Generale SA, Turkey has already tested the patience of investors enough, even as assets become cheaper than those of other emerging markets.

“I simply struggle to find one single silver lining or a compelling narrative to back the idea of bottom fishing," said Roxana Hulea, an emerging-market strategist at Societe General in London.