January futures fluctuated in New York. The details of a deal will be finalized Tuesday and “everybody is on board,” Nigerian OPEC delegate Ibrahim Waya said in Vienna, where the group is meeting to discuss output quotas ahead of a summit next week. Libyan OPEC Governor Mohamed Oun said Monday that talks had gone well. Government data on Wednesday is projected to show U.S. crude supplies rose a fourth week, according to a Bloomberg survey.

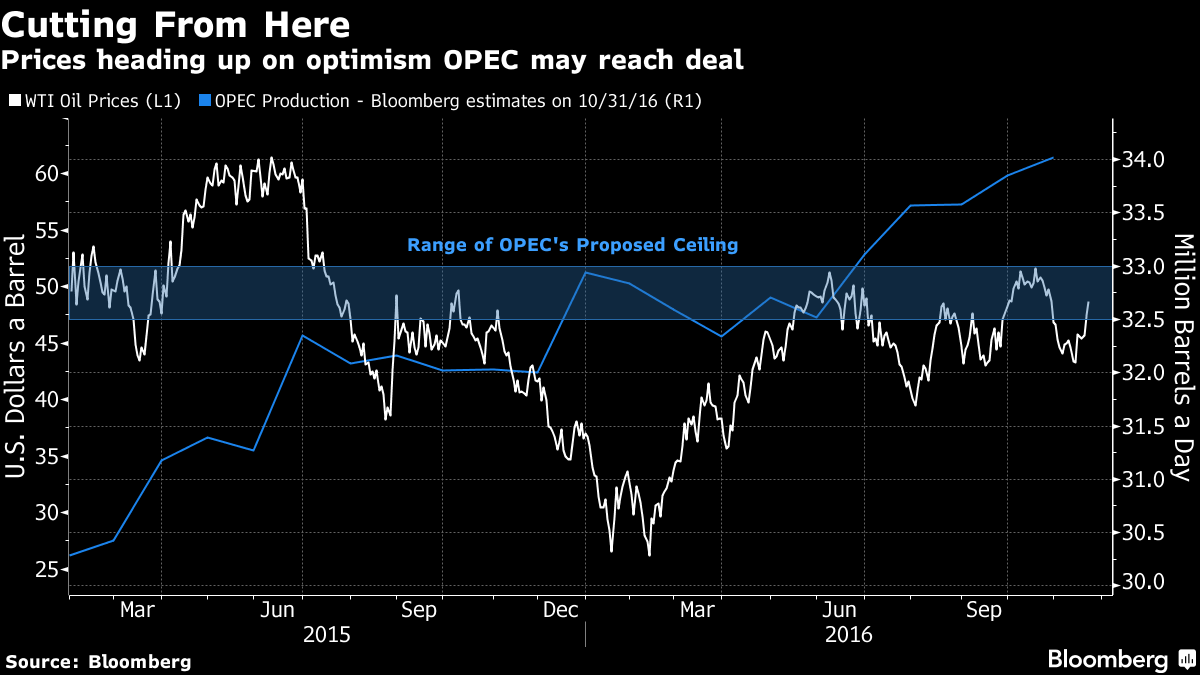

Oil has rebounded from an eight-week low on Nov. 14 as members of the Organization of Petroleum Exporting Countries make renewed diplomatic efforts before their Nov. 30 meeting to finalize the supply deal they informally agreed to in September. The group’s plan to trim output for the first time in eight years is complicated by Iran’s determination to boost volumes, a revival of production in Nigeria and Libya, and Iraq’s request for an exemption.

"The market is going to move on OPEC headlines until the meeting in a little more than a week," said Gene McGillian, manager of market research for Tradition Energy in Stamford, Connecticut. "We should float around in this area until next Wednesday. I doubt prices will top $50 unless the Saudis make a statement."

West Texas Intermediate for January delivery rose 10 cents to $48.34 a barrel at 11:02 a.m. on the New York Mercantile Exchange. December futures expired Monday after rising $1.80 to $47.49, the highest close for a front-month contract since Oct. 28. Total volume traded was about 54 percent higher than the 100-day average.

Contango Widens

Brent for January settlement rose 38 cents, or 0.8 percent, to $49.28 a barrel on the London-based ICE Futures Europe exchange. The contract touched $49.96, the highest since Oct. 28. The global benchmark traded at a 94-cent premium to WTI.

The WTI contango -- where near-term deliveries are cheaper than those further out -- grew, a sign of ample supply. This market structure can encourage further inventory gains because it allows investors to buy crude cheaply, store it in tanks and lock in profit for later sales using derivatives contracts.

"Widening contango is telling us that this is a very oversupplied market," said Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York. "This increases the pressure on OPEC to come up with a deal. There’s trouble on the horizon for OPEC if they don’t succeed."

OPEC representatives meeting in Algiers in September proposed limiting output to a collective 32.5 million to 33 million barrels a day. That remains the main proposal being considered, Nigeria’s Waya said. “Everyone knows that the stakes are high,” he said.

OPEC Ramblings

"There are a lot of ramblings coming from OPEC," said Tim Pickering, founder and chief investment officer of Auspice Capital Advisors Ltd. in Calgary. "I’m usually an optimist, but not when it comes to OPEC coming to agreement. We have to pay close attention to the various statements because they aren’t all in agreement."

In the U.S., an Energy Information Administration report on Wednesday is forecast to show crude inventories rose by 250,000 barrels last week, according to a Bloomberg survey. Stockpiles climbed 21.7 million barrels in the three prior weeks, EIA data show. The industry-funded American Petroleum Institute is scheduled to release its weekly supply figures this afternoon.

Oil-market news:

- The likelihood of an OPEC deal drove an increase in the oil-price outlook at Goldman Sachs Group Inc., which now expects WTI at $55 in the first two quarters of next year, up from prior estimates of $45 and $50, respectively, according to a note on Monday.

- The chairman of the Commodity Futures Trading Commission is trying to push ahead with controversial rules clamping down on traders’ ability to speculate in oil and other commodities before President-Elect Donald Trump takes office, according to people familiar with the matter.