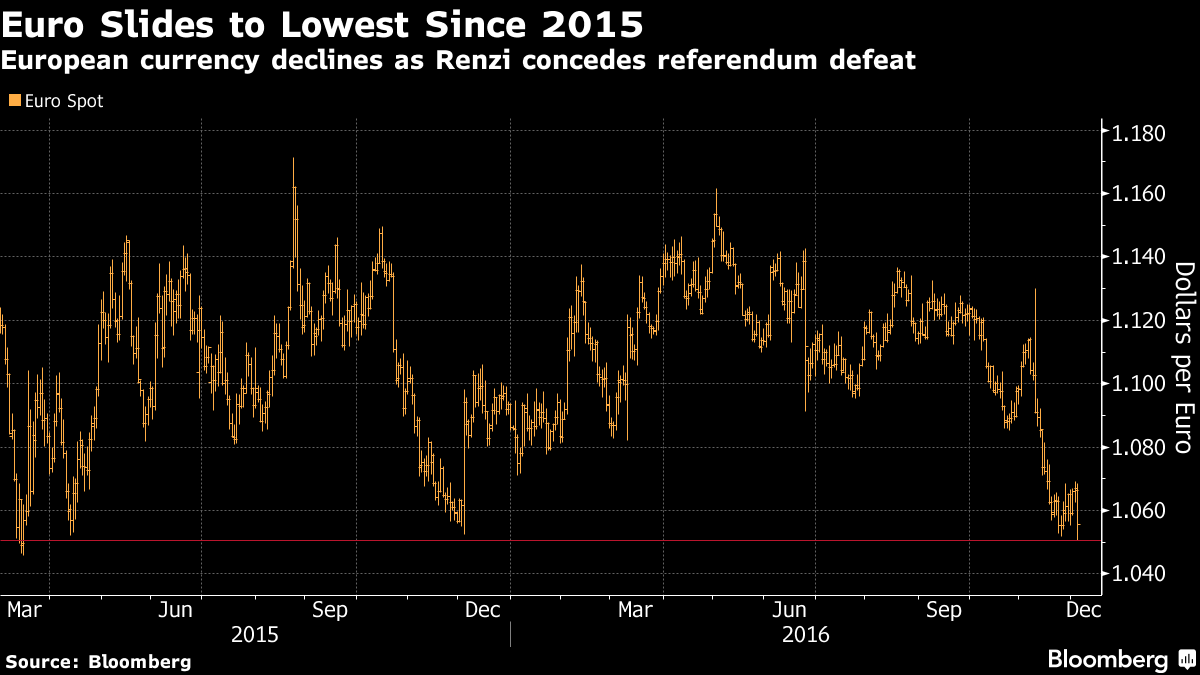

According to Bloomberg, the single currency dropped against most of its 16 major counterparts as the referendum on Renzi’s plans to rein in the power of the Senate was defeated by 59.1 percent to 40.9 percent, according to the final tally. The euro pared losses following the premier’s speech, while the yen erased an earlier advance against the dollar. Italy’s 10-year bond yield climbed the most in three weeks, paring last week’s decline.

The result is the latest in a series of votes that have roiled financial markets in 2016, following Britain’s vote to leave the European Union in June and Donald Trump’s victory in last month’s U.S. presidential election. Still, with a “no” vote largely expected, the initial currency-market reaction is relatively muted compared to those events -- the pound fell by more than 10 percent as it became clear the U.K. had voted for Brexit, while the dollar swung wildly in the hours following Trump’s win.

“The moves were contained because everybody expected a ‘no’ today,” said Jens Peter Sorensen, chief analyst at Danske Bank A/S in Copenhagen. “I am not optimistic on this one. There is no need to be brave here and start buying BTPs. I don’t see this as a very positive sign for the euro, because now one of the biggest countries in the euro zone is in a political mess.”

The euro dropped 0.2 percent to $1.0646 as of 8:37 a.m. in London, after falling earlier 1.5 percent to $1.0506, the lowest since March 16, 2015.

Italy’s 10-year yield climbed 10 basis points to 2.01 percent, having dropped 19 basis points last week.

While the referendum has raised concerns over Italy’s future in the euro region, the nation’s political and legal system mean a “no” vote is unlikely to trigger a quick exit.

“Markets tend to react much faster to changes of environment now,” said Yannick Naud, head of fixed income at Banque Audi (Suisse) SA in Geneva. “There is now a possibility of the euro reaching parity to the dollar. Maybe not right away, but it is a possibility if there is certainty regarding new elections.”

- The extra yield demanded by investors for owning the nation’s 10-year bonds instead of German bunds surged on Nov. 28 to the most since June 2015. The spread was 169 basis points Monday

- Before the vote, some investors saw the currency as the best way to play the referendum since the European Central Bank’s asset-purchase program provides a source of support for fixed-income securities

- The nation’s benchmark FTSE MIB Index of shares fell on Monday and has dropped around 20 percent this year

- While Renzi’s concession initially roiled other currencies, the fallout was limited. The yen erased a gained of as much as 0.6 percent against the dollar