Emerging-market equities and oil prices may have bottomed, helping the Norwegian and South African currencies, while the pound has room to claw back sharp losses following the Brexit vote. In the rates world, German bund and U.K. gilt prices have the potential to rebound from now into the start of next year as the surge in yields meets strong resistance, according to Bloomberg.

- While GBP/CHF trades below the down-trendline from December 2015, leading MACD has already broken out bullishly, pointing to more spot upside. There’s scope for a deeper retracement to 1.3403-1.3603 (50 percent retracement and 61.8 percent Fibonacci, trendline and cloud base) where tactical consolidation may emerge. Above here will bring into frame a 1.40 target-zone (9 percent from the current spot), which captures a larger order Fibonacci and cloud top (note: cloud top drops to 1.35 in late March). High-price distribution at about 1.40 may trigger another round of consolidation.

- A weekly close below 1.2253 would question the bullish setup.

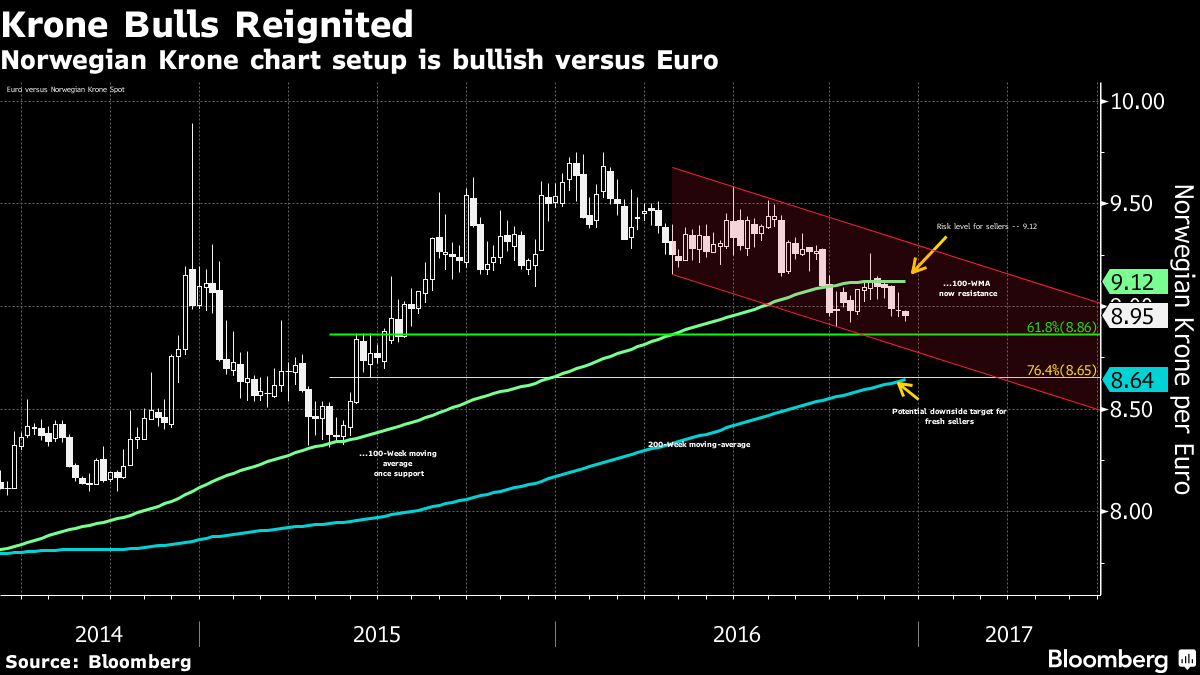

- EUR/NOK rolled over in November against its 100-week moving average (9.1217), which confirmed its role-switch from support-to-resistance. The first target support is at 8.8610 (61.8 percent Fibonacci) and then 8.6515-6413 (76.4 percent Fibonacci and 200-week moving average). An overshoot target is at 8.3128 (2015 low), 7 percent away from the current spot

- The krone’s bullishness ties in with a constructive medium-term view on crude oil prices (see more here).

- A weekly close above 9.1217 (the 100-week moving average) would question the bearish stance.

- The USD/ZAR chart shows consolidation since August below its 55-week moving average at 14.78, with the trend outlook staying bearish while below that level. It could break 13.20 support to target 12.23-10, the 50 percent retracement of its 2011-2016 rally and the 200-week moving average level. This would be a move of 12 percent from its current level.

- Also supportive is the emerging market equity index bounce in mid-Nov. from a neckline of an inverse head-and-shoulders pattern, as well as the emerging market foreign-exchange index carving a bottom against weekly cloud support.

- A weekly close above 14.65 in USD/ZAR would question this bearish scenario.

- In German bunds, mean-reversion risks are intensifying in 10-year yields as the top of ichimoku cloud curtails the surge for a second week (this week at 41bps), in a development similar to last December when the cloud top was rejected in every single weekly test.

- Yields are also facing resistance from 42-43bps, the late October break-down point and 50 percent retracement of the 2015-2016 rally; nine-week RSI is at about 70 (just like last December). Setbacks may find support from 21-ExpMA and the 50 percent retracement of the latest selloff at 15bps-13bps.

- A weekly close above 43bps this week (or this month) would be a significant bearish development for bunds and opens up 58bps (61.8% Fibonacci) and then the 74bps level seen last December.

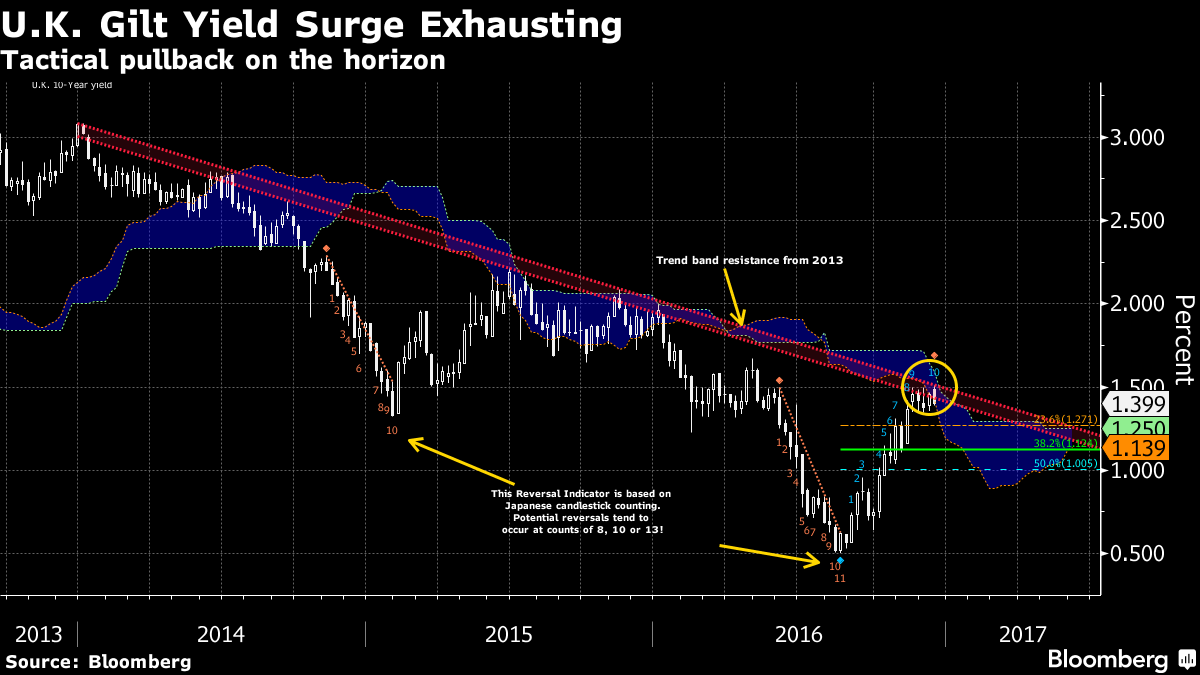

- Gilt yields are testing major trend-band resistance at 1.43 percent/1.51 percent, which also captures the weekly cloud hurdle. The appearance of trend-exhaustion candle counts (current count is 10) on weekly charts may lure tactical buyers. Provided yields do not exceed the 1.51 percent high this week, the retracement target levels are at 1.27 percent (23.6 percent Fibonacci) and 1.12 percent (38.2 percent Fibonacci).

NOTE: Sejul Gokal is a technical strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice.