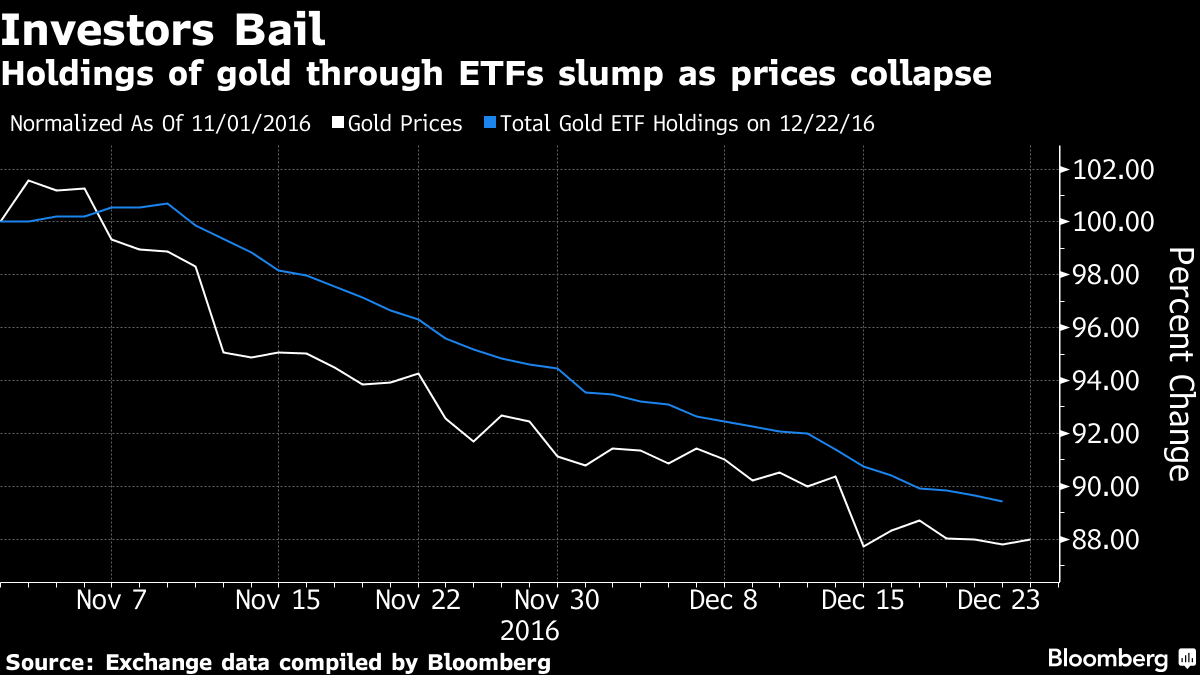

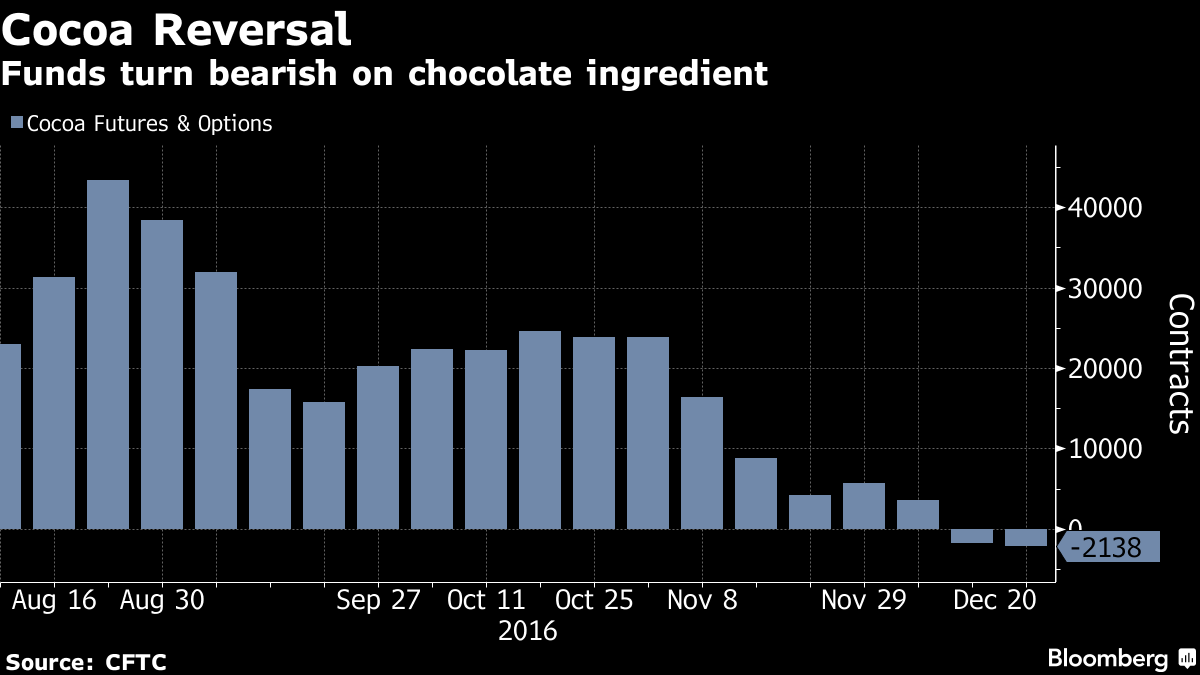

Bullion futures in New York have already fallen for seven straight weeks, the longest stretch in more than a decade. With equity markets trading near all-time highs, investors are backing away from bets that gold could rebound. Another boon for the season: money managers are wagering that cocoa prices will keep falling, good news for those who want to keep indulging in chocolate after the Christmas festivities, according to Bloomberg.

Here’s a round-up of other highlights from the latest weekly release of data from the U.S. Commodity Futures Trading Commission: Investors are the most bearish on corn since mid-October as rains benefit crops in South America. The funds also trimmed their wagers on gains for cotton, copper, sugar and soybeans. One bright spot was livestock: the money managers are the most bullish on cattle since June 2015 and also grew more optimistic on hogs.

Gold’s 2016

It’s been an erratic year for gold, with the biggest first-half rally in almost four decades giving way to a retreat as focus shifted from political uncertainty on the Brexit vote to U.S. monetary policy. Holdings through exchange-traded products have shrunk continuously since Donald Trump won the U.S. election, fueling optimism fiscal stimulus will energize the economy and driving a gauge of the dollar to the highest levels since at least 2005.

“It’s a changing of the trend,” said Erik Tatje, a market strategist at RJO Futures in Chicago. “As we look at a rising interest-rate environment, that will add value to the dollar. That will put tremendous downside pressure on gold.”

The hedge funds lowered their gold net-long position, or bets on price gains, by 22 percent to 53,911 futures and options in the week ended Dec. 20, the CFTC data published three days later show. That was a sixth straight decline, the longest streak this year. Gold futures on the Comex in New York dropped 0.3 percent in the week to close at $1,133.60 an ounce on Friday.

Other precious metals aren’t faring much better. Silver futures fell to the lowest since April, and platinum and palladium are both heading for monthly declines. The net-long position in silver shrunk 5.7 percent to 43,359 contracts, the fifth drop in six weeks.

If you’re planning to make up for late Christmas gifts with something sparkly, just be sure to do it before diamond prices rebound.

Cheap Chocolate

Looking for a more wallet-friendly apology? Head to the candy aisle. Cocoa prices are poised for their first annual decline since 2011. Output gains mean the market is shifting from a production deficit to the biggest surplus in six years, Citigroup Inc. has said. And after a soaring start to the year, sugar futures are now on pace for a third straight monthly loss in New York as a production shortage eases.

Money managers have positioned for more losses in cocoa. They’ve got a net-short position, or wagers on price declines, of 2,138 contracts, which compares with 1,733 last week. The last time investors were net-bearish was in 2012. The sugar net-long holding fell 8.2 percent to 146,709 contracts, the lowest since April.