“The Brexit journey is really just beginning; while the direction of travel is clear, there will be twists and turns along the way,” the BOE governor told a press conference in London on Thursday. “We can see scenarios in either direction” for policy, according to Bloomberg.

U.K. growth has been resilient since the Brexit vote, Mark Carney says https://t.co/wazC7FADXB pic.twitter.com/qSABSkUhvM

— Bloomberg Brexit (@Brexit) February 2, 2017

The BOE upgraded its economic forecasts for the second time since the Brexit vote and revealed that some policy makers have become more concerned about accelerating inflation. Stronger-than-expected growth -- reflecting an easier fiscal stance, buoyant consumer spending and an improving global environment -- is countered by the risk that Brexit will ultimately hurt the economy.

The Monetary Policy Committee now sees gross domestic product rising 2 percent this year, up from 1.4 percent in November.

“The stronger projection doesn’t mean the referendum is without consequence,” Carney said.

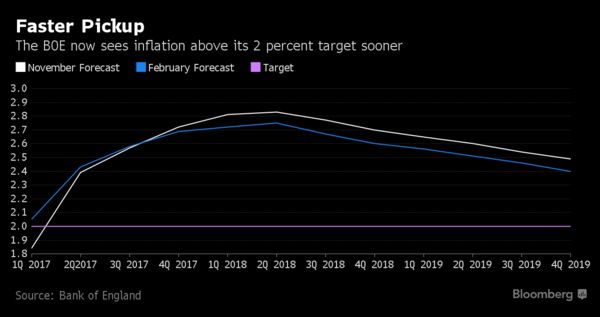

The solid expansion, coupled with a pickup in price growth, saw rate setters repeat that they have limited tolerance for inflation above their 2 percent target. Some members went further and said they are “closer to those limits.” Inflation is forecast to accelerate through this year and peak at 2.8 percent in 2018.

New EU deal will have an effect on the British economy's potential growth, Mark Carney says https://t.co/wazC7FADXBpic.twitter.com/u0EquBUbDw

— Bloomberg Brexit (@Brexit) February 2, 2017

“If we do see a situation where there is faster growth and wages than we anticipated or spending doesn’t decelerate later in the year, one can anticipate there would be an adjustment of interest rates,” Carney said.

For now though, the BOE is keeping its key rate at a record-low 0.25 percent and its bond-purchase programs unchanged. It said there’s more slack in the economy than previously thought so the jobless rate can fall further without generating inflation.

The pound fell, with the currency down 0.7 percent at $1.2577 at 2:07 p.m. London time. Gilts advanced, pushing the yield on the 10-year security down seven basis points to 1.38 percent.

Fed Assessment

Carney is giving himself time to assess the potential longer-term economic fallout from Brexit. The Federal Reserve took a similarly cautious tone on Wednesday, giving little signal on the timing of its next rate increase as it tries to figure out what President Donald Trump’s actions mean for the U.S. outlook.

The BOE sees inflation averaging 2.7 percent this year and 2.6 percent in 2018, little changed from its November projections. It will slip back to 2.4 percent in 2019. The forecasts are based on market expectations for an interest-rate increase early that year, though the curve has steepened since the forecasts were completed.

Currency Volatility

The pickup in prices partly reflects the pound’s 15 percent drop since the Brexit vote last June. The upward pressure has eased somewhat, with sterling up 3 percent since the November forecasts.

Policy makers said further currency volatility is likely as more details about the EU exit emerge. They also expect faster price growth to weigh on consumers, though less than previously thought.

The BOE was more optimistic about the labor market in the coming years, seeing the jobless rate about half a percentage point lower than previously anticipated. It cut its estimate of the equilibrium rate to 4.5 percent from 5 percent, which is lower than the current level of 4.8 percent.

While the Brexit impact on the economy has been limited so far, the U.K. hasn’t actually begun the formal exit process. Prime Minister Theresa May plans to trigger that by the end of next month.

New Arrangements

“With time, the U.K. economy’s supply will be affected by a new set of trading arrangements with the EU and other countries,” Carney said.

In the shorter term, the effect on supply is mostly determined by firms’ investment plans in anticipation of those potential arrangements, he said. The “key judgments” the MPC will have to make are the scale of business reaction and how that impacts productivity and employment, he said.