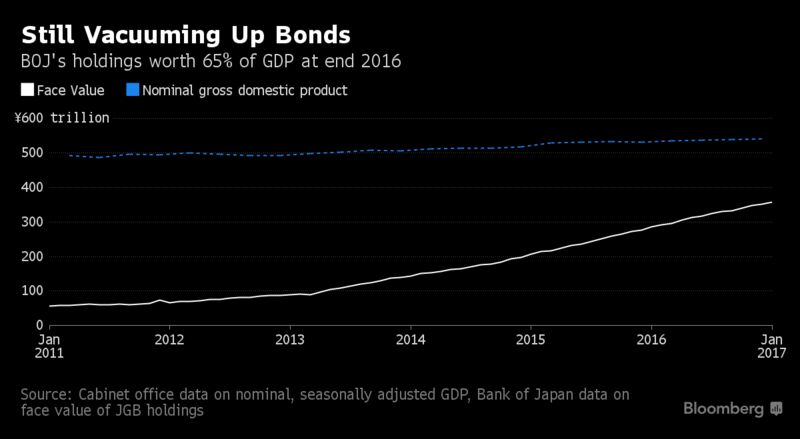

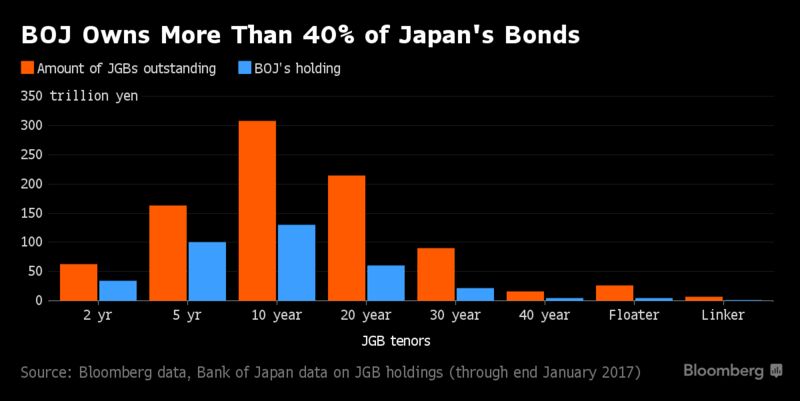

According to Bloomberg, the BOJ holds more than 40 percent of Japanese government bonds, according to data compiled by Bloomberg. While its holdings of all Japanese sovereign securities -- including bonds and bills together -- are still shy of the yardstick that Kuroda mentioned with some levity in October 2014, the central bank’s stake continues to rise and rise.

There are no signs of that expansion stopping or slowing anytime soon, even as the central bank’s need to control yields drives unprecedented purchases of benchmark 10-year debt, exacerbating concerns it will run out of willing sellers to supply it with bonds to buy.

“The BOJ actually decreased the pace of purchases late last year, but after the market started to price in the risks they would taper, that drove the yield up to 0.15 percent, and forced the central bank to accelerate again,” said Daiju Aoki, an economist at UBS Group AG in Tokyo. Policy makers currently have a 0 percent 10-year yield target.

The BOJ snapped up a record 2.1 trillion yen ($18 billion) of five- to 10-year JGBs between Feb. 3 and Feb. 8 -- buying on three out of four trading days. The haul, which included an emergency “fixed-rate” operation, was a record for that maturity band since Kuroda started his mega-stimulus in April 2013. The central bank stepped in after 10-year yields spiked to a one-year high of 0.15 percent, threatening to becoming unhinged from the BOJ’s target.

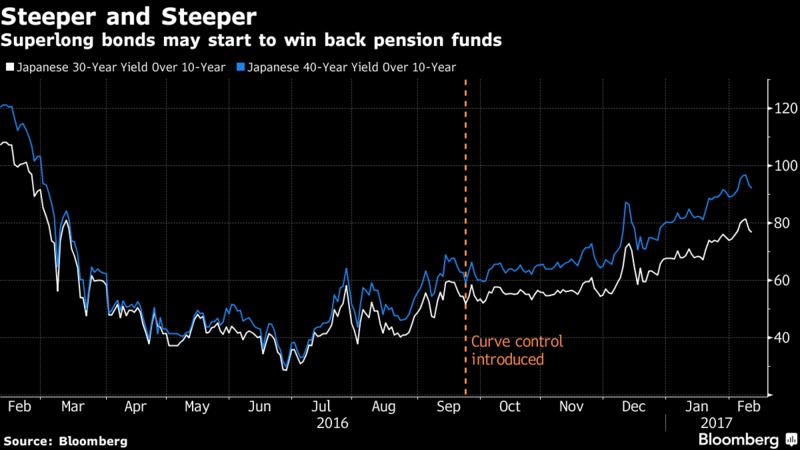

The yen rallied after the increased operations showcased concerns the BOJ’s shift to targeting the yield curve hasn’t removed questions about the durability of its quantitative easing. Kuroda and his colleagues had highlighted how the new framework, enacted in September, would make Japan’s monetary policy more sustainable.

The new regime was also aimed at steepening the yield curve -- and it has certainly done that. The premium that 30-year notes offer over 10-year debt has widened since November at the fastest pace in more than six years, reaching 82 basis points last week. That contrasts with the 50 basis point level seen when yield-curve control was introduced.

And with Japanese investors selling off Treasuries at the fastest pace since 2013, it also raises the likelihood of pension funds and life insurers, which need long-term assets to meet similar liabilities, being drawn back to so-called superlong bonds -- worsening the BOJ’s potential supply constraint. Also raising stimulus-sustainability issues: banks are seen getting closer to their target limits when it comes to selling down JGB holdings.

Japan’s banks sold 141 trillion yen of government debt in the first 3 1/2 years of Kuroda’s easing, playing a key role in supplying the 298 trillion yen that the BOJ bought in the same period. Banks have just 219 trillion yen of the securities left, and they need to keep some of that to meet regulatory requirements. That all adds up to the real possibility that the BOJ will face constraints on its capacity to buy bonds.

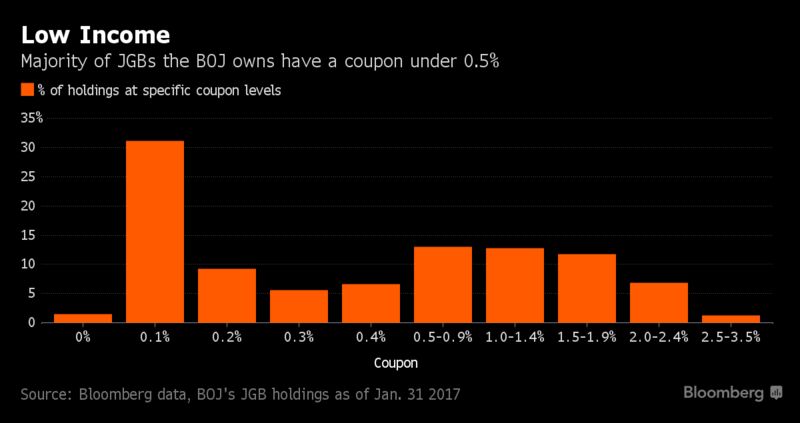

At least a climb in yields may end the vicious cycle the BOJ was creating for itself when its actions drove rates on all Japan’s bonds to almost zero. That had raised the specter of eroding the BOJ’s balance sheet thanks to diminishing bond returns. Even so, almost a third of the bonds it owns have no income -- or just pay it 0.1 percent a year in interest.

The surge in bond prices over the past four years could still create losses for the BOJ, because most of the debt it buys costs well above face value, even though face value is what the central bank will get back, because it plans on holding the securities to maturity. The looming balance sheet shortfall that creates is another of the concerns surrounding the long-term sustainability of the policy.

“The BOJ doesn’t seem to care about exceeding 40 percent, so they will maintain the pace of buying for now -- though they face the prospect of running out of bonds to acquire some time next year,” UBS’s Aoki said. “Any exit from the program is a very, very long way away.”

Looking forward, it seems the BOJ can’t stop buying, otherwise it would lose control of yields while its inflation target remains far from 2 percent. Yet it can’t go on buying forever either, thanks to a lack of ready sellers. With his term due next year, Kuroda may not be around to rue his 2014 crack.