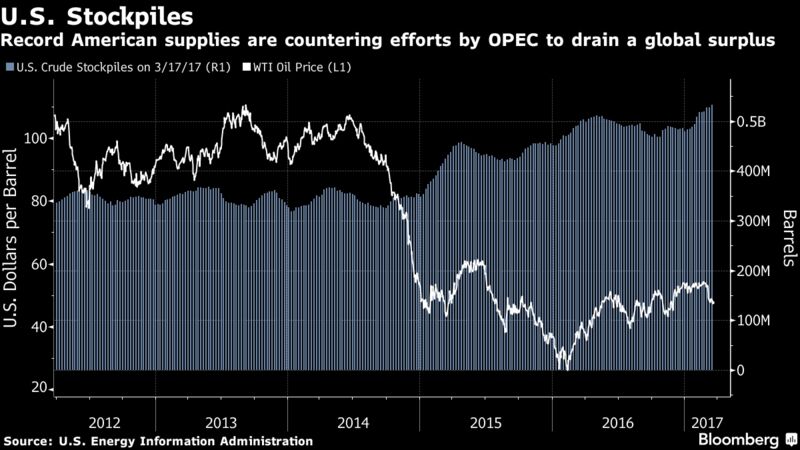

Futures slipped 1.7 percent this week in New York. U.S. crude output continued to expand along with inventories last week, data from the government showed on Wednesday. While OPEC won’t formally decide until May whether to prolong a production-cut deal aimed at easing a global glut, officials will meet this weekend in Kuwait to discuss its progress, Bloomberg reported.

Oil this week slid below $48 a barrel, the lowest prices since November, as the U.S. supply glut and increased drilling activity continued to counter output cuts by the Organization of Petroleum Exporting Countries and other producers. OPEC will extend the cuts if stockpiles are still above their five-year average, Saudi Arabian Energy Minister Khalid Al-Falih said in a Bloomberg interview last week.

"Breaking through $50 was bearish psychologically," Rob Thummel, a managing director and portfolio manager at Tortoise Capital Advisors LLC who helps manage $17.2 billion, said in an interview. "The probability of OPEC extending the cuts is even higher with prices in the $40s."

West Texas Intermediate for May delivery rose 27 cents to settle at $47.97 a barrel on the New York Mercantile Exchange. Front-month futures closed at $47.34 on Tuesday, the lowest settlement since Nov. 29. Total volume traded was about 39 percent below the 100-day average.

Brent for May settlement rose 24 cents to $50.80 a barrel on the London-based ICE Futures Europe exchange. Prices fell to $50.56 on Thursday, the lowest close since Nov. 30. The global benchmark slipped 1.9 percent this week. Brent closed at a $2.83 premium to WTI.

Futures climbed in late trading Friday as attention shifted to the weekend summit in Kuwait, according to Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York.

Implementation Committee

"It looks like some guys are unloading short contracts ahead of the semi-OPEC meeting this weekend," Yawger said by telephone.

A five-nation committee established to monitor implementation of the accord, finalized on Dec. 10 last year, will meet in Kuwait City on March 26. OPEC achieved 91 percent of its pledged cuts last month, while Russia and other allies delivered about 44 percent, according to data from the International Energy Agency.

"We may get some kind of comment out of Kuwait this weekend but it’s important to remember it’s the compliance monitoring group that’s gathering, so we shouldn’t expect policy to be made," Tim Evans, an energy analyst at Citi Futures Perspective in New York, said by telephone.

See also: East Africa’s oil ambitions tested by pipeline machinations

U.S. crude production expanded for a fifth week to 9.13 million barrels a day last week, the longest run of gains since January 2016, according to Energy Information Administration data. Nationwide stockpiles increased by 4.95 million to 533.1 million barrels in the week ended March 17. Inventories are at the highest level in weekly EIA data compiled since 1982.

“OPEC pushed an extra 1.5 million barrels a day of exports and production really late into last year, that’s the effect we’re seeing now, ” Amrita Sen, chief oil analyst at Energy Aspects Ltd., said in a Bloomberg television interview. “You’re going to start seeing the effects of the cuts pretty much from next week onwards.”

Oil-market news:

-

TransCanada Corp. said it has been granted a U.S. permit for the Keystone XL pipeline to the American heartland following approval by President Donald Trump.

-

OPEC’s supply cuts are providing a windfall for producers of heavy crude from western Canada and the Gulf of Mexico.

- Russia and Saudi Arabia head to this weekend’s OPEC committee meeting as the tortoise and hare of a global deal to cut oil supply, with Moscow sticking to a slow and steady pace despite Riyadh’s cajoling.

- The surge in U.S. drilling is raising costs for Halliburton Co., which now sees first-quarter earnings per share in "low single digits."