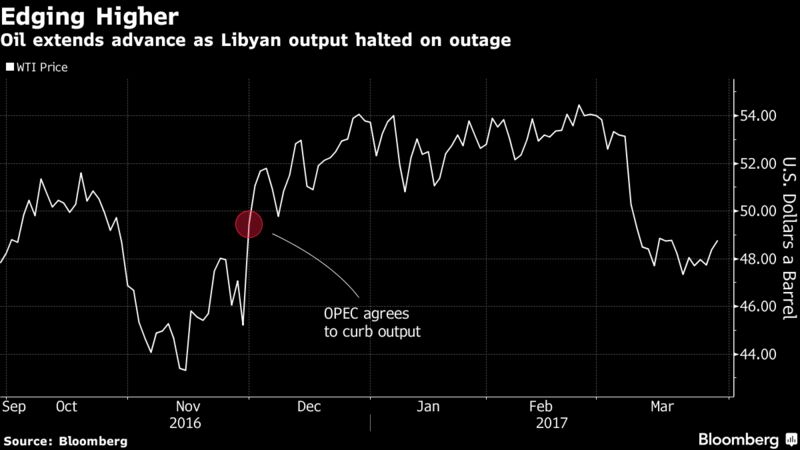

Libya’s output was said to fall to about 500,000 barrels a day after a pipeline carrying crude from the Sharara field -- its biggest -- stopped operating. Clashes between armed groups in the nation have previously led to market disruptions, and the latest news drove New York oil futures up as much as 1 percent after boosting them 1.3 percent on Tuesday. Prices are headed for two straight days of gains for the first time in more than a month, according to Bloomberg.

The production drop in Libya, which was pumping 700,000 barrels a day before the pipeline halt, is at least temporarily easing concern that rising U.S. supply is offsetting the effect of curbs by the Organization of Petroleum Exporting Countries and its allies. U.S. industry data on Tuesday was said to show crude inventories climbed last week, and a government report Wednesday is also forecast to show stockpiles expanded. Six OPEC nations have joined with non-member Oman to voice support for prolonging their output cuts past June.

“The global oil market is now in deficit because of production curbs by OPEC and Russia,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich. “For investors with a higher risk appetite, we regard current oil prices as a buying opportunity for outright long positions.”

West Texas Intermediate for May delivery was at $48.65 a barrel on the New York Mercantile Exchange, up 28 cents, at 12:47 p.m. London time. Total volume traded was about 33 percent below the 100-day average. The contract gained 64 cents to $48.37 on Tuesday.

Brent for May settlement was up 34 cents at $51.67 a barrel on the London-based ICE Futures Europe exchange, and traded at a $3.03 premium to WTI. The global benchmark crude climbed 58 cents, or 1.1 percent, to $51.33 on Tuesday.

Libya’s state-run National Oil Corp. was said to declare force majeure on loadings of Sharara crude from the Zawiya oil terminal and on loadings of Wafa field condensate from the Mellitah terminal. Force majeure is a legal status protecting a party from liability if it can’t fulfill a contract for reasons beyond its control.

Oil market news:

- U.S. crude stockpiles rose by 1.91 million barrels last week, the American Petroleum Institute was said to report Tuesday; Energy Information Administration data Wednesday is forecast to show inventories increased by 2 million barrels.

- OPEC is likely to extend its supply accord beyond June as crude inventories haven’t been falling as fast as expected, according to Vitol Group, the world’s biggest independent oil trader.