According to Bloomberg, personal spending advanced just 0.1 percent in February after a 0.2 percent gain a month earlier, reflecting fewer auto purchases and a drop in outlays for electricity and natural gas amid milder weather, Commerce Department data showed Friday. Incomes, however, climbed 0.4 percent from January and were up 4.6 percent from February of last year, the largest gain since May 2015.

Economists, despite projections of softer consumption in the first quarter that’s been a common theme the last three years, expect stronger spending growth will reemerge. One cautionary note is the steady pickup in inflation, which last month exceeded the Federal Reserve’s goal for the first time since 2012 and will pinch wallets.

“It’s a weak start to the year,” said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York. “A lot of it was the weather, and spending could have been held back by the slow payout of tax refunds. This is a blip, and consumer spending will recover in the second quarter. The fundamentals for spending look good.”

Consumer Confidence

Separate figures from the University of Michigan showed consumer sentiment climbed in March as a gauge of perceptions about current conditions including personal finances rose to the highest level since July 2005.

The Commerce Department’s personal consumption expenditures price index, the Fed’s preferred measure of inflation because it’s based on what consumers are purchasing, rose 2.1 percent in February from a year earlier, the fastest pace in almost five years. Central bankers, who raised interest rates at their March meeting, are expected to lift them further this year following progress on their full employment and 2 percent inflation goals.

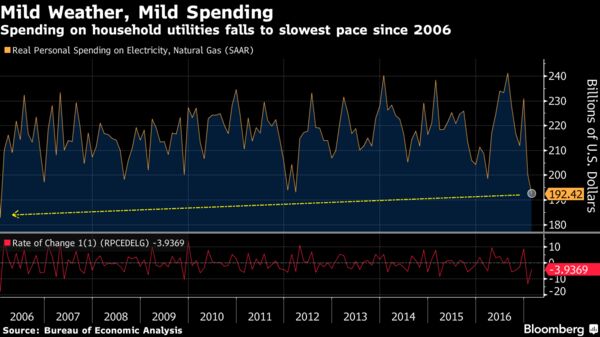

Adjusting consumer spending for inflation, which generates the figures used to calculate gross domestic product, purchases fell 0.1 percent after a 0.2 percent decrease the previous month. Economists said unusually mild winter weather -- February was the second-warmest on record, according to the National Oceanic and Atmospheric Administration -- and delayed tax returns explain much of the slowdown.

In February, household outlays on services fell 0.1 percent for a second month after adjusting for inflation. Spending on electricity and natural gas to heat homes dropped 3.9 percent last month after plunging 13.2 percent in January.

Utility spending in January and February represented the weakest two-month stretch in more than 25 years, according to Feroli.

Economists at Morgan Stanley and Barclays Plc were among those who trimmed forecasts for first-quarter consumer spending, which means economic growth will also be weaker than was anticipated before the Friday report. The Atlanta Fed’s GDPNow model estimates U.S. growth of 0.9 percent.

“It would be a mistake to think this is a new trend” in spending, Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a note after the report. Real income growth is consistent with annualized spending gains of 2 percent to 2.5 percent, he wrote.

While a Bloomberg survey of economists from March 10 to March 16 projects 2.6 percent spending growth in the second quarter, there are risks it could disappoint.

Sales of automobiles -- a big-ticket item -- cooled entering 2017 and were flat the past two months. Cars and light trucks sold at an annualized 17.5 million pace in both January and February, down from 18.3 million in December, according to Ward’s Automotive Group data.

Rising delinquencies also point to signs of trouble in lending for automobiles. Steve Eisman, the Neuberger Berman Group fund manager who was featured in Michael Lewis’s book “The Big Short,” said he’s concerned about the U.S. subprime-auto market, though he thinks it’s not a big enough asset class to cause problems for the financial system as a whole.